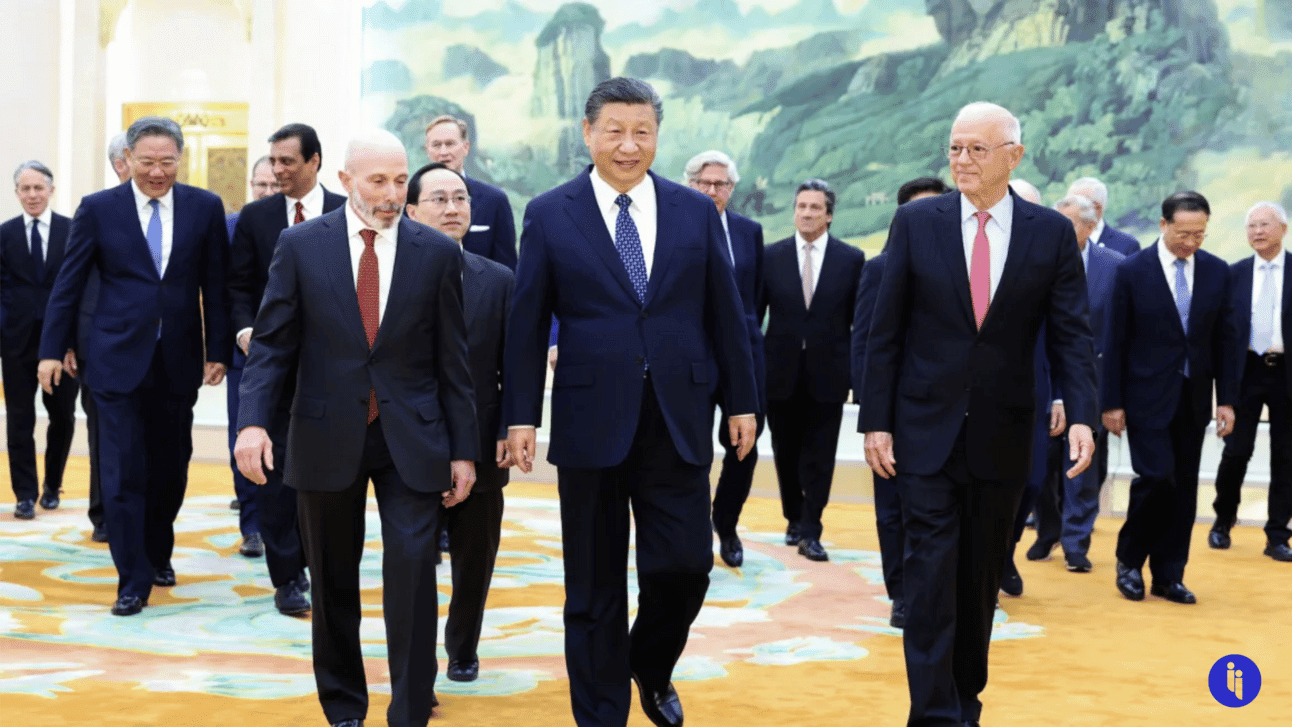

China’s leader, Xi Jinping, held a last-minute meeting with 20 US business leaders in Beijing yesterday (Wednesday) as part of a broader charm offensive.

The CEOs were in town for Beijing’s annual flagship China Development Forum. But before flying out, they received a cryptic invite to meet a “top Chinese leader“. That same elliptical language had appeared in invites to Xi’s dinner with CEOs in San Francisco last November, so they duly cleared their schedules.

The group of bigwigs that then emerged (🇨🇳) on state TV with Xi in Beijing’s Great Hall of the People included familiar faces, including from Blackstone, FedEx, and Bloomberg, plus chipmakers Qualcomm and Broadcom, and even Harvard professor Graham Allison.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 160,000+ subscribers

No spam. No noise. Unsubscribe any time.

What’d they say?

Everyone in the room ended up rehearsing familiar lines, but it’s still worth recapping them here. In the 90-minute meeting, Xi reportedly (🇨🇳) said:

- “China-US relations cannot go back to the old days, but they can embrace a brighter future”

- China hasn’t “peaked“, but rather its prospects remain “bright“

- China will continue building a “first-class business environment“, and

- There’s nothing “inevitable” about the ‘Thucydides Trap‘ (the term popularised by Professor Allison above, to describe the history of conflict between rising powers like China and established powers like the US).

Xi reportedly then “listened carefully” as the visiting executives raised their own familiar lines around the need to offer a fairer playing field for foreign companies in China, including better protection for intellectual property, and more transparency and predictability around China’s business rules.

So if it was all so familiar, why did Xi host this last-minute meeting? Three main reasons.

First, it’s a follow-up to his San Francisco dinner with US CEOs last November (plus his meeting with President Biden, which helped stabilise US-China ties). Of course, it’s still been an eventful five months since then: just this week, China filed its suit against US electric vehicle subsidies at the WTO, while the US and the UK levelled major allegations of mass hacking by China.

Second, there’s probably a degree of compensation at play, both for the fact that Xi is skipping this week’s annual Boao Forum (aka ‘the Chinese Davos’), plus for the fact that Premier Li Qiang’s annual meeting with foreign CEOs at the China Development Forum was axed earlier this week.

But third and most crucially, this surprise audience is a response to real domestic and international concerns around China’s economy. Net foreign direct investment (FDI) collapsed by 80% last year, FDI itself is at its lowest levels since 1993, and consumer confidence is still hovering near recent lows.

So Xi’s meeting is really part of a broader full-court-press including Beijing’s first-ever ‘Invest in China Summit’ this week, a new 24 point action plan (relaxing various visa and investment rules), and its highly-anticipated new regulations (🇨🇳) to ease oversight of data heading overseas.

These kinds of public, investor-friendly acts are a way for Xi to ease some of the pressure he must be feeling abroad and, we can only assume, at home too.

INTRIGUE’S TAKE

Now, we’ve got to ask this: if you’re looking to ease concerns about your government’s predictability and transparency… is a last-minute invite to meet an unnamed senior official going to do the trick? Maybe not.

But that’s what happened, and it’s one of the many competing messages criss-crossing the Pacific right now. You’ve got the Pentagon saying China presents “the most comprehensive and serious challenge” to the US, while US CEOs get star-struck in the People’s Hall.

You’ve got Xi telling the world that China is open for business, while simultaneously spooking its neighbours with a massive military build-up.

You’ve got American CEOs criticising China’s continued government role in the economy, while Washington ramps up its own role in response.

And you’ve got China listening carefully to calls to boost its domestic consumption and then… boosting its massive manufacturing overcapacity instead – cue more global anxiety about China.

That’s the bewildering reality of a relationship this vast and complex. So then, in that context, will this week’s actions change anything? No. But do they reveal anything? Yes. In our view, they reveal the extent to which Xi clearly now realises the scale of the challenges ahead.

Also worth noting:

- Apple CEO Tim Cook was also invited to the audience with Xi, but he was already running his own charm offensive in Shanghai.

- The same day, Xi also met Dutch PM Mark Rutte. Seemingly referring to limits on Dutch chip equipment exports to China, Xi reportedly said that “no force can stop the pace of China’s scientific and technological development and progress.”