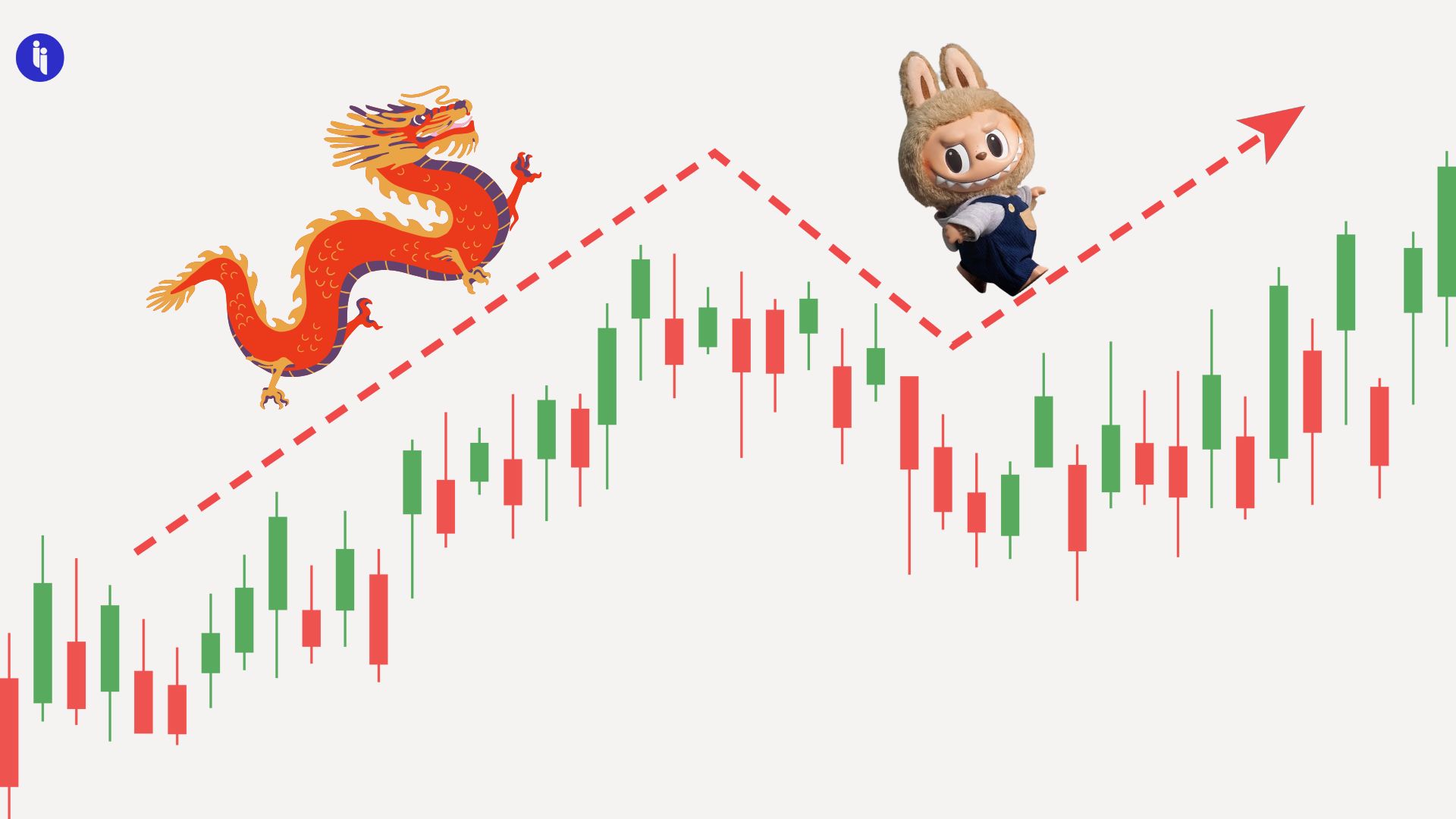

China’s equities are so hot right now. How hot? So hot.

- Shares have added nearly a trillion dollars in value in just the past month, and

- China’s key CSI 300 index is up 15% just in August alone, to a decade high.

So let’s take a quick look at why:

- Government backing.

We’ve shared a few updates on the Party’s repeated efforts to revive China’s economy. And while the fundamentals are still lagging, market sentiment is now enjoying a bump.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 142,000+ subscribers

No spam. No noise. Unsubscribe any time.

One clear example is in China’s slow-motion property collapse, which has shrugged off most government stimulus to date, and yet real estate shares are now surging. Why?

- a) Premier Li just used a cabinet meeting to (again) pledge a halt to the decline

- b) The cities of Shanghai and Beijing just eased more home-buying rules, and

- c) There’s speculation there’ll be more support ahead to keep the good headlines rolling for next week’s big WWII “Victory Day” parade (with guests like Putin).

That’s all raised hopes maybe China’s real estate slump has finally hit the bottom. But the question is (again) whether those hopes are well-founded, particularly as estimates still do the rounds warning of tens of millions of empty, unsold dwellings.

Meanwhile, an apparent end to the government’s crackdown on the tech sector has contributed to local market euphoria around…

- AI.

There are several interesting drivers here:

- a) Big international events such as the first World Humanoid Robot Games and Shanghai’s big global AI conference (attended by Intrigue) have shone a light on the many legit advances now playing out in China’s tech sector, like…

- b) Local startups such as Z.ai now claim better models than even famed local rival DeepSeek, which in turn just released its own update to the model that first shocked the world back in January. DeepSeek says it’s now optimising for…

- c) “Soon-to-be-released next-generation domestic chips” — US export curbs have complicated China’s chip ambitions, but DeepSeek is signalling optimism. That, plus Beijing’s warnings against US chips, has all helped local alternatives surge.

And of course, who fills China’s euphoric tech world…?

- Gen Z.

References to those screen-obsessed Gen-Z types can seem a bit glib, but in China we’re talking about a quarter of a billion people! And contrary to their parents, local Gen Zers spend much more than their ~17% population share would suggest.

They also spend that cash differently, with recent surveys suggesting they prioritise what a Fudan thinktank has dubbed ‘emotional consumption’. What’s that?

Current share rallies point the way, with firms like…

- Pop Mart (maker of the iconic Labubu dolls) announcing a massive 400% profit bump to overtake JD.com’s market cap at $55B

- Homegrown viral luxury jewellery brand Laopu up 211% this year, and…

- No Gen Z can finish the day without a hit of bubble (boba) tea, making Yun’an Wang a billionaire by listing his Guming empire earlier this year.

Though of course, there are ‘buts’ at play, too: like the anecdotal evidence of more youth falling into debt spirals. And meanwhile, the sheer force of this bull run has now nudged some big players to start imposing trading limits, suggesting fears of a correction ahead.

Intrigue’s Take

We’ve focused on some of the drivers within China, but of course a big one comes from abroad: this local market sentiment probably also reflects a belief that President Trump’s trade crackdown on China won’t be as sharp as first feared.

We’ve previously looked at the reasons, including earlier US market freak-outs, China’s leverage over inputs like rare earths, continued truce extensions, and a pattern of other US deals suggesting maybe there’s a grand bargain China’s economy can absorb.

And a Trump-Xi meeting around Korea’s APEC summit in late Oct/early Nov seems the natural time and place to announce that kind of deal. But if that’s the case, it doesn’t leave much time to meaningfully address the big underlying US-China economic imbalances. If we instead see more of a splashy deal (pledges to buy more soybeans and Boeings), while otherwise extending the status quo, China’s stocks could be in for another run.