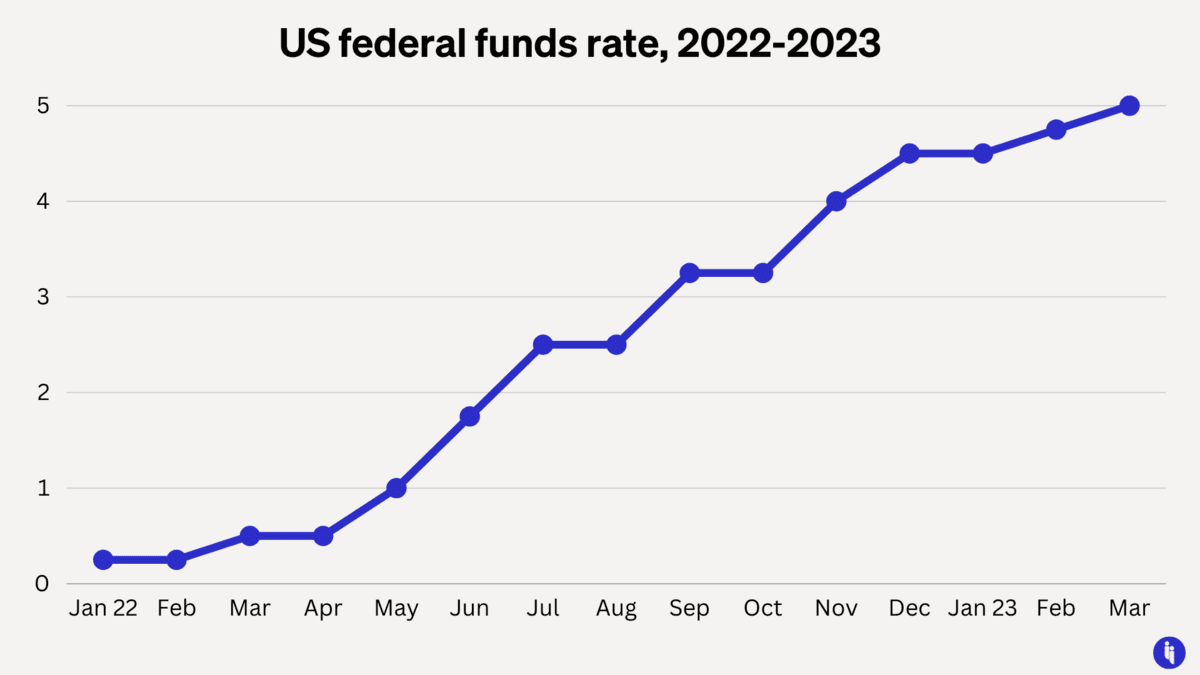

Briefly: The US Federal Reserve increased interest rates by another quarter point on Wednesday, seeking to cool a hot economy without further spooking jittery markets. US rates are now at their highest level since 2007.

Most economists were (by Wednesday) expecting this decision. But just a week ago, things weren’t so clear:

- After four bank failures in 11 days, some thought the economy didn’t need the Fed’s help to cool down

- And others worried a decision not to raise rates might’ve spooked markets, by suggesting the Fed held concerns for the financial system’s stability

The Fed Chair (Jerome Powell) was clearly mindful of all this. And initial systemic fears seemed to have receded by Wednesday. So he took the calculated risk that he could tame inflation without spreading further financial turmoil.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 129,000+ subscribers

No spam. No noise. Unsubscribe any time.

Intrigue’s take: Imagine you’re flying a plane. A cockpit alarm goes off, but it’s not yet clear what it means. You’ve got to make a decision, but it might make things worse. Oh, and it’ll be a year before we know if you’ve saved the day or crashed the plane.

That’s Powell’s job right now. And given the Fed’s global influence, we’re all passengers. The last time a pilot faced this kind of decision was 2007-8 and, though the facts were different, we all know how that ended. We’ll find out next year whether Powell got it right this time.

Also worth noting:

- Central banks around the world (eg, Philippines, Taiwan, Saudi Arabia, Qatar, Switzerland, and the UK) quickly followed the US Fed’s lead and raised rates.

- Financial markets are functioning, though one analyst described the primary loans market as a “Scooby Doo ghost town.”