Briefly: Argentina jacked interest rates from 91% to 97% yesterday (Monday) to tame inflation and avoid a currency crash before October’s presidential elections.

It’s now going through its worst economic crisis in decades:

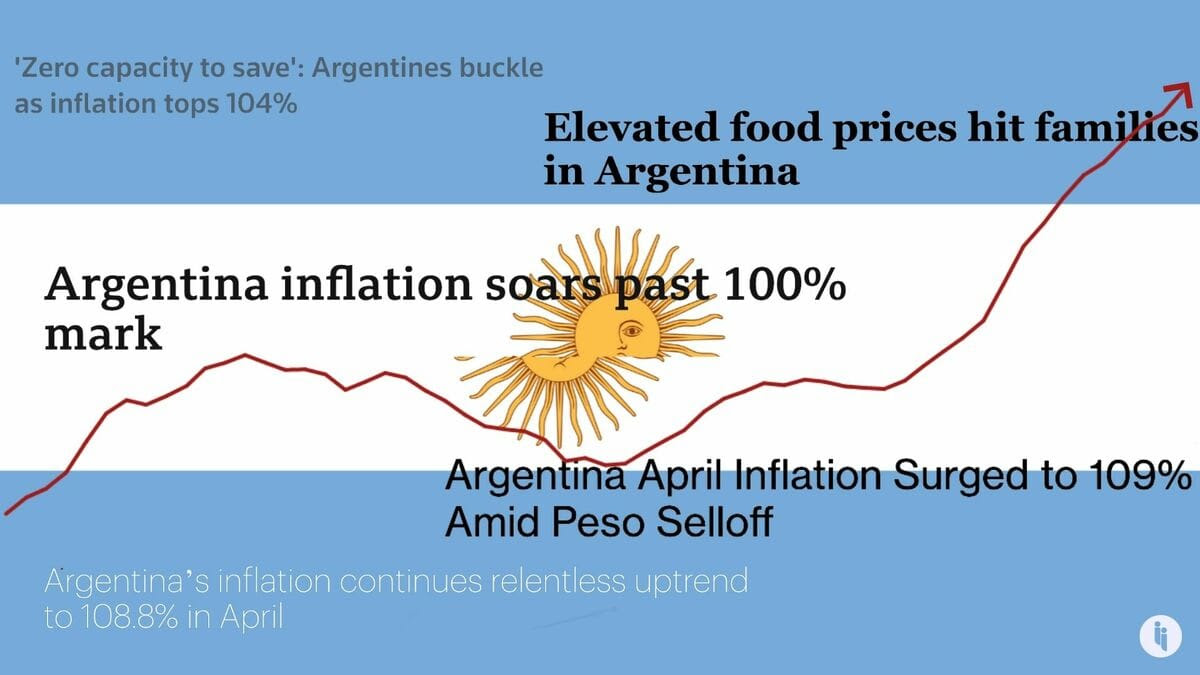

- 📈 Inflation is above 108%

- 📉 The peso has lost 35% of its value against the dollar this year, and

- 🐌 Its GDP is set to grow by just 0.2% this year, according to the IMF

In sum, the country’s economic Aires aren’t exactly Buenos right now. And that’s making life pretty tough for Argentina’s 46 million people.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 99,000+ subscribers

No spam. No noise. Unsubscribe any time.

Intrigue’s take: Hiking interest rates by 600 basis points isn’t typically part of most re-election campaigns, but Argentina doesn’t have many options. The IMF is already disbursing a $44B bailout it previously agreed with Argentina, and China has already entered into a currency swap.

So if these new sky-high interest rates don’t cool off the country’s red-hot inflation, it’s hard to see what else will.

Also worth noting:

- The 97% interest rate in Argentina compares with 6.5% in India, 5.25% in the US, and 3.75% in Europe.

- Libertarian and outsider presidential candidate Javier Milei is leading in some polls. He’s campaigning to curtail state intervention in Argentina’s economy and replace the peso with the US dollar.