Beijing is reportedly weighing a ~$278B intervention into China’s stock market, with an announcement expected as soon as this week.

To put that into perspective, China spent ~$240B bailing out 22 countries struggling with their Belt and Road Initiative payments from 2008 to 2021.

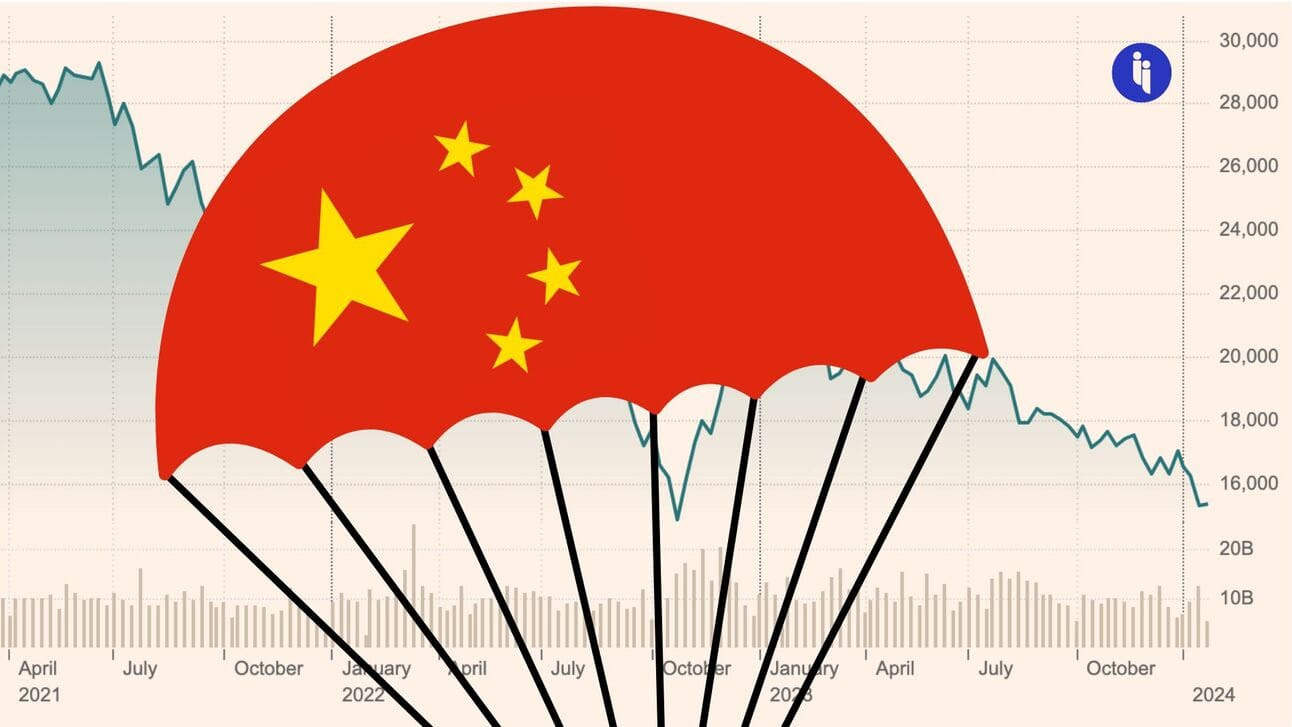

It’s been a tough few years for China’s stock markets:

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 99,000+ subscribers

No spam. No noise. Unsubscribe any time.

- An index tracking the Shanghai and Shenzhen stock markets (the CSI 300 Index) has lost a third of its value since 2021. It closed at a five-year low on Monday.

- Hong Kong’s market is down 10% this year, making it the worst-performing market in Asia.

- And China’s overall foreign investment flows have turned negative for the first time since records began in 1998.

What’s causing all this?

China’s stock market is like a straw in the wind, and right now, it’s being buffeted by a mix of economic challenges like rising debt, record youth unemployment, a shrinking population, a real estate crisis, and government crackdowns. All that has eroded investor confidence, which is showing up in falling stock prices.

Markets have been waiting for President Xi to jolt things back to life with rate cuts and stimulus, as China did back in 2008 in a package worth $586B. But this time, he’s moved slowly, mindful of possible side-effects on debt, the yuan, and beyond.

Why intervene now?

Problems in China’s stock market are metastasising from the economic to the political. More than 220 million Chinese people are invested in stocks. Combine that with households who’ve already got 70% of their wealth tied up in a limp property sector, and you’ve got a lot of anxious and potentially very angry people.

That’s got to be unnerving for Xi and the Chinese Communist Party, whose political legitimacy is tied to China’s prosperity.

So, here’s how Xi plans to respond: Bloomberg reports that his team is looking to use offshore funds held by state-owned enterprises (SOEs) and pool them to “buy shares through the Hong Kong exchange link” and halt the market’s fall.

But reactions so far have been mixed.

While Chinese and Hong Kong stocks jumped on the news, international investors seem less convinced: a $278B package, while big, probably isn’t big enough to address China’s underlying problems.

INTRIGUE’S TAKE

It’s hard to think of a better way to encapsulate China’s unique model: using offshore funds from state-owned enterprises to prop up a stock market.

But will it work?

Maybe this move helps stabilise prices and puts a floor under consumer confidence. Or maybe it doesn’t, and the malaise spreads to SOEs who end up holding a quarter of a trillion dollars in declining stocks.

When talking about the animal spirits of a market, the outcome often rests less on the substance of any package and more on the signal it sends.

The signal Xi likely wants to send here is that he means business. But the signal many will actually hear is that he’s worried.

Also worth noting:

- On Monday, Chinese Premier Li Qiang called for ”forceful” interventions to “enhance the inherent stability of the market”, walking back his comments in Davos last week that China “did not resort to massive stimulus”.