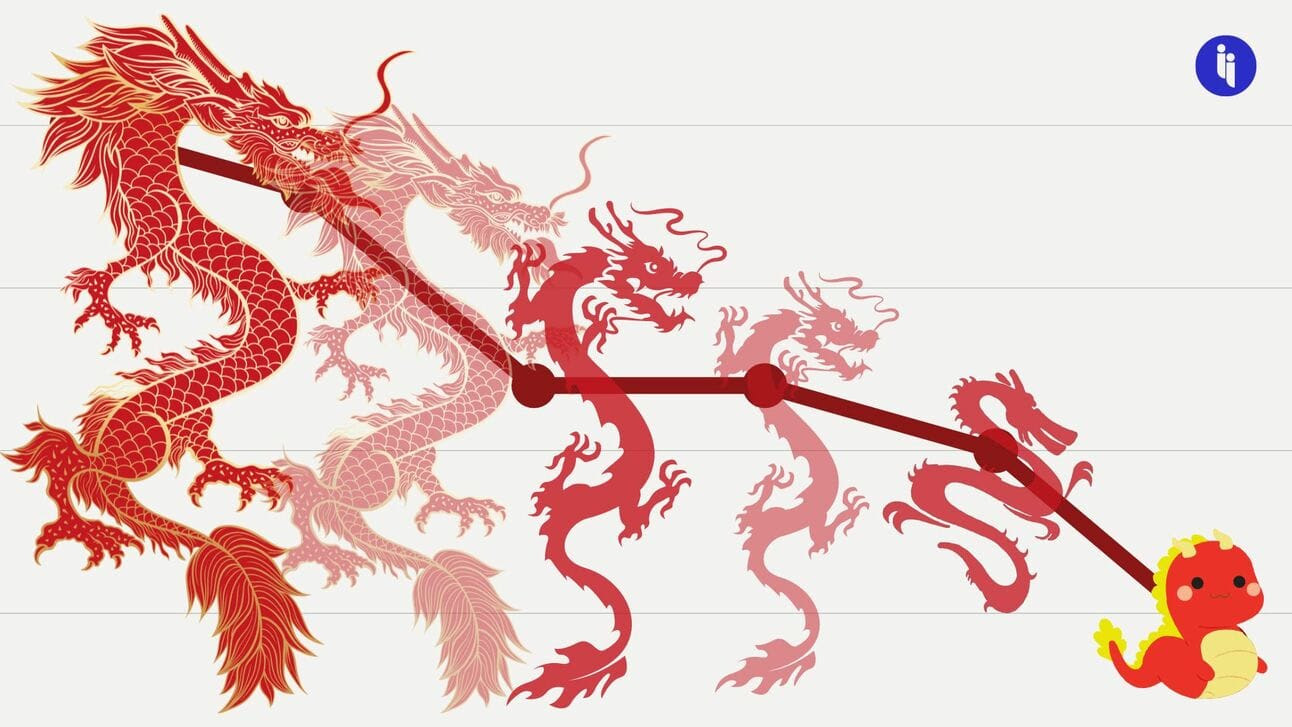

Briefly: China’s exports fell by 7.5% in May compared to the same period last year, a much larger decline than the 1.8% contraction expected by economists.

On the other hand, imports only fell by 4.5% instead of the projected 8%. Taken together, these signals suggest:

- 🇨🇳 China is still recovering, and hoovering up what the world sells, but

- 🌏 The shaky global economic outlook may be tapping its brakes.

And given China’s export sector accounts for ~20% of its GDP, this risks being more of a handbrake than a lil’ tap.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 134,000+ subscribers

No spam. No noise. Unsubscribe any time.

The broader data coming out of China is pretty mixed, too:

- 🏭 Manufacturing contracted in May

- 🏠 Home sales are still rising but at a slower pace than earlier this year

- 🧳Dining and travel spending is up, but still at pre-COVID levels, and

- 🧢 Urban unemployment fell overall, but rose among 16-24 year-olds

So there are real questions around the strength of China’s recovery.

Intrigue’s take: Context is key, particularly when looking at monthly data.

First, look at the timeframe: this latest data compares to last year, so… what was happening then? China was bouncing out of COVID, and its trade stats were notably higher.

Second, look at prices: sure, the data says imports are down, but that may be because China is paying lessfor many key imports (like commodities and chips).

And third, look around: exports also fell in South Korea (15.2%), Vietnam (6%) and elsewhere, reflecting a broader global slowdown.

So the big picture here may be better for China than it seems. And yet… with China’s system being so opaque, few things are ever as they seem.

Also worth noting:

- China’s stats bureau will release more data on June 15. The Politburo, the Communist Party’s top body, is expected to meet in late July and announce any policy responses to this latest data.

- China’s car exports hit a new record in May, as the country overtook Japan to become the world’s largest exporter. Around 60% of China’s EV exports to Europe are deliveries for Western brands.