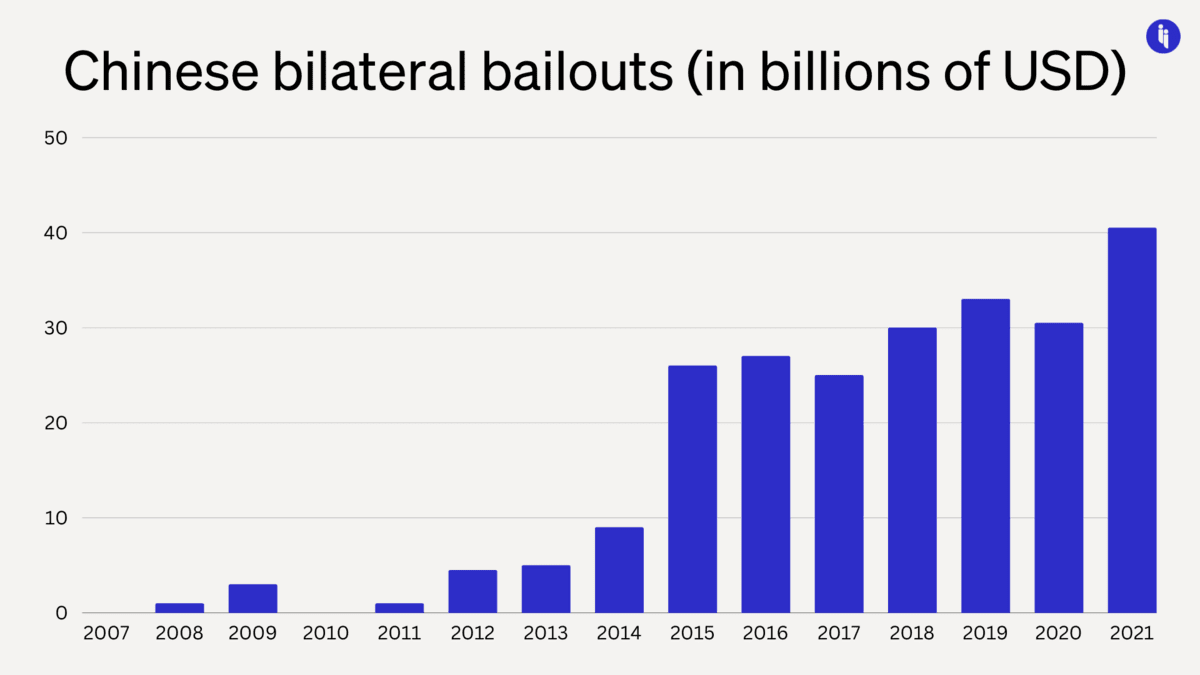

Briefly: China issued $240B in bailouts to debt-saddled developing countries between 2000 and 2021, according to a recent study. And more than half of that was just in the final four years of the study. So China’s rescue loans are big, and getting bigger (fast).

China has used its Belt and Road Initiative (BRI) to fund infrastructure projects around the world. These projects often carry more risk than Western lenders are willing to tolerate. When the borrowers end up in distress, China generally charges 5% interest on its rescue loans (compared to 2% at the IMF).

The end result? After ten years and a trillion dollars (or more!) in total expenditure, China’s BRI has delivered plenty of infrastructure projects around the world. Some of them have been subpar. And many host countries are now finding themselves under mountains of unpayable debt.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 99,000+ subscribers

No spam. No noise. Unsubscribe any time.

Intrigue’s take: The world has tried to boost international development a million different ways over the years. And China’s own record at home is pretty remarkable: lifting 800 million people out of poverty in four decades.

But just like an Australian trying to buy ‘thongs’ in the US, we’re seeing that what makes sense at home can get you into trouble abroad. In this case, China’s tried and tested strategy at home (fire-hosing cash to build infrastructure) is proving trickier abroad.

Also worth noting:

- According to the same study, 5% of China’s overseas loan recipients were debt distressed in 2010; by 2022, that figure had grown to 60%.

- Last week, Sri Lanka’s President Ranil Wickremesinghe asked China and other lenders to cooperate to help his country restructure its debt.