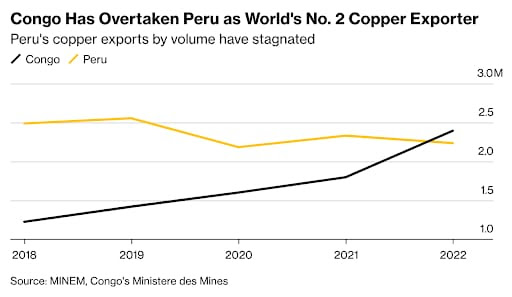

Briefly: The Democratic Republic of the Congo (DRC) replaced Peru as the world’s second-biggest exporter of copper last year, in terms of shipment volumes. It’s a notable shift in the copper industry, which has long been dominated by South American countries.

What’s behind this switch in copper rankings?

- 🇵🇪 Peru’s copper production has flatlined since 2016, in part due to political instability there, and

- 🇨🇩 DRC has tapped into its higher-grade ore potential (meaning more metal can be extracted from the same amount of rock), enabling copper exports to double to 2.4 million tons between 2018 and 2022.

Intrigue’s take: Countries generally define a ‘critical mineral’ as something that ticks three key boxes:

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 99,000+ subscribers

No spam. No noise. Unsubscribe any time.

- 🏗️ Its supply chain is vulnerable to disruption

- 🔒 It’s essential to economic and national security, and

- 👩💻 It plays a key role in energy, defence and other tech

Copper ticks each of these three boxes. It’s particularly key to the energy transition. And that makes it the subject of intense geopolitical interest.

Also worth noting:

- While Peru is now ranked 3rd and DRC ranked 2nd, Chile remains the world’s top copper exporter.

- Peru’s China-owned Las Bambas mine, one of the biggest copper mines in the world, halted production numerous times last year due to environmental and community protests.