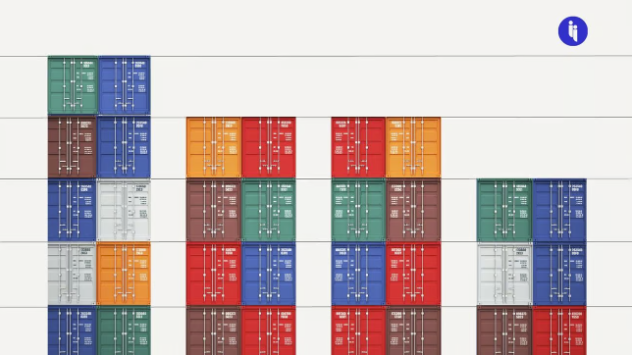

After a couple of years of sky-high profits, the shipping industry is spending record amounts to expand its fleets. But global trade is now decelerating.

What’s happening? The shipping sector has a long boom-bust tradition:

- 📈 When shipowners are profiting, they plough cash into new ships

- 📉 But when those new ships are delivered, the spike in capacity can crash freight prices, putting pressure on the shipowners.

And that’s what’s happening now. COVID triggered the sector’s most profitable years ever, so the sector went on its biggest shopping spree ever:

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 99,000+ subscribers

No spam. No noise. Unsubscribe any time.

- 🚢 new ships worth $90B are due for delivery in coming years

- 🛳️ adding 890 ships to current global shipping capacity.

The shipyards building the vessels (mostly in China and Korea) will do well, but the picture’s a little more mixed for the ship-buyers themselves, because:

- 🏭 Inventory levels are high as consumer demand cools

- 🏗️ More containers are entering than leaving major Chinese ports

- 📦 Shipping from China to the US costs 85% less than a year ago, and

- 🗃️ Container production has fallen by over 70%.

So as trade slows, the shipping industry is bracing for a slowdown too, just as hundreds of new ships are starting to enter service.

Intrigue’s take: The shipping industry and the global economy have a very co-dependent relationship, like Michael Bay and explosions.

But this time, the bigger players still have record piles of cash to weather the storm, so they may end up buying any smaller players that struggle. That’ll further concentrate an industry that’s already 85%-controlled by ten firms.

Silver lining? Older, dirtier ships will go more quickly into retirement. And that’ll leave us with a newer and greener fleet, sooner.

Also worth noting:

- Responding to the International Maritime Organization’s 2050 net zero targets, some firms are ordering methanol-powered vessels.

- There are around 6,500 container ships in service around the world.