Chips Ahoy!

“More chips!” is one of the few orders that would work in both a Mexican restaurant and the White House Office of Science and Technology Policy. But the similarities stop when it comes to picking up the bill:

- On 6 December, semiconductor giant Taiwan Semiconductor Manufacturing Company (TSMC) announced it will spend $40B to build a new semiconductor fabrication plant, one of the biggest foreign investments in US history.

US President Joe Biden confidently announced the plant would be a “game changer” for the ongoing US efforts to boost domestic tech capabilities.

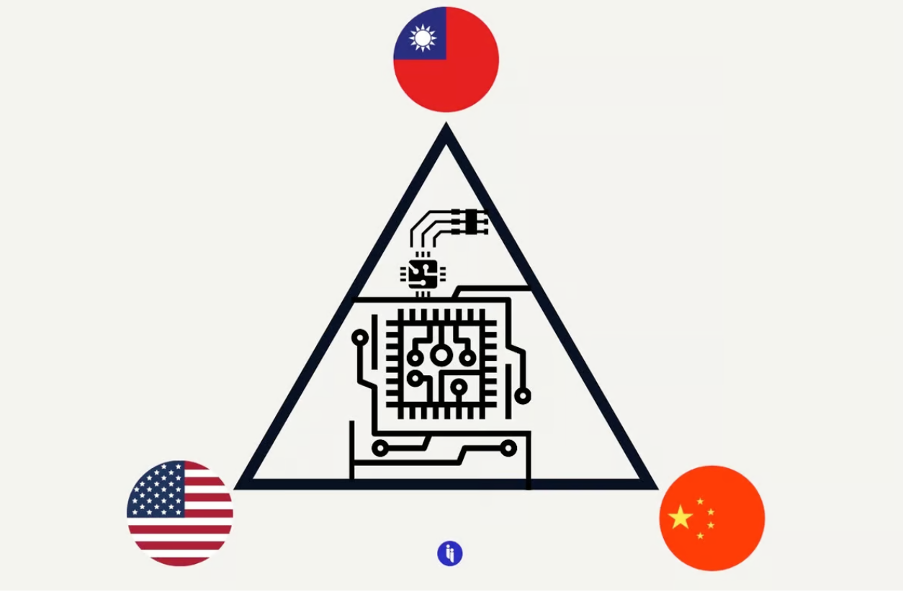

Great Chip Triangle

The expansion of TSMC’s business in the US is a big development in the ‘Great Chip Triangle’, a high-stakes game of geopolitics involving the US, China, and Taiwan. One of the saga’s main imperatives – technological supremacy – is pushing the US to aggressively invest in securing its own semiconductor supply chain with Taiwan’s help.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 99,000+ subscribers

No spam. No noise. Unsubscribe any time.

- Earlier this year, the Biden Administration passed the CHIPS and Science Act, which sets aside $52B in funding to boost semiconductor research, development, and production.

But analysts are split over what this means for TSMC’s and Taiwan’s future. Some worry that US plans to boost domestic manufacturing and reduce its reliance on ‘made-in-Taiwan’ chips will undermine Taiwan’s so-called ‘silicon shield’.

As Rupert Hammond-Chambers, President of the US-Taiwan Business Council argues:

“[t]he US and Europe must walk the line between onshoring vital production capacity while not marginalising and weakening Taiwan economically in the process (which would be to deliver to China one of its core goals).”

Other analysts believe such fears that US investments will weaken Taiwan are overblown. And, as plenty of analysts have noted, these US-based fabs will still be umbilically linked to their headquarters in Taiwan.

- The two new TSMC fabs won’t be operational until 2024 and 2026, respectively, meaning that Taiwan will remain geopolitically critical for a while yet.

Besides, as Senior Associate at the Center for Strategic and International Studies Paul Triolo notes, “TSMC production in Arizona will be at most 1-2% of capacity on Taiwan when fab starts operations”.

What’s in it for TSMC?

Instead of reducing US reliance on Taiwanese-made chips, having important TSMC fabs on US soil will likely tie the two countries even closer together:

“These fabs be uncompetitive economically and much less of a hedge against Chinese invasion than you might think… TSMC will have to bear the cost but if that is the price of shoring up U.S. support for Taiwan, well, that is the best possible insurance policy the company could buy for its operations that truly matter, which are intrinsically tied to Taiwan.”

Ben Thompson, tech analyst