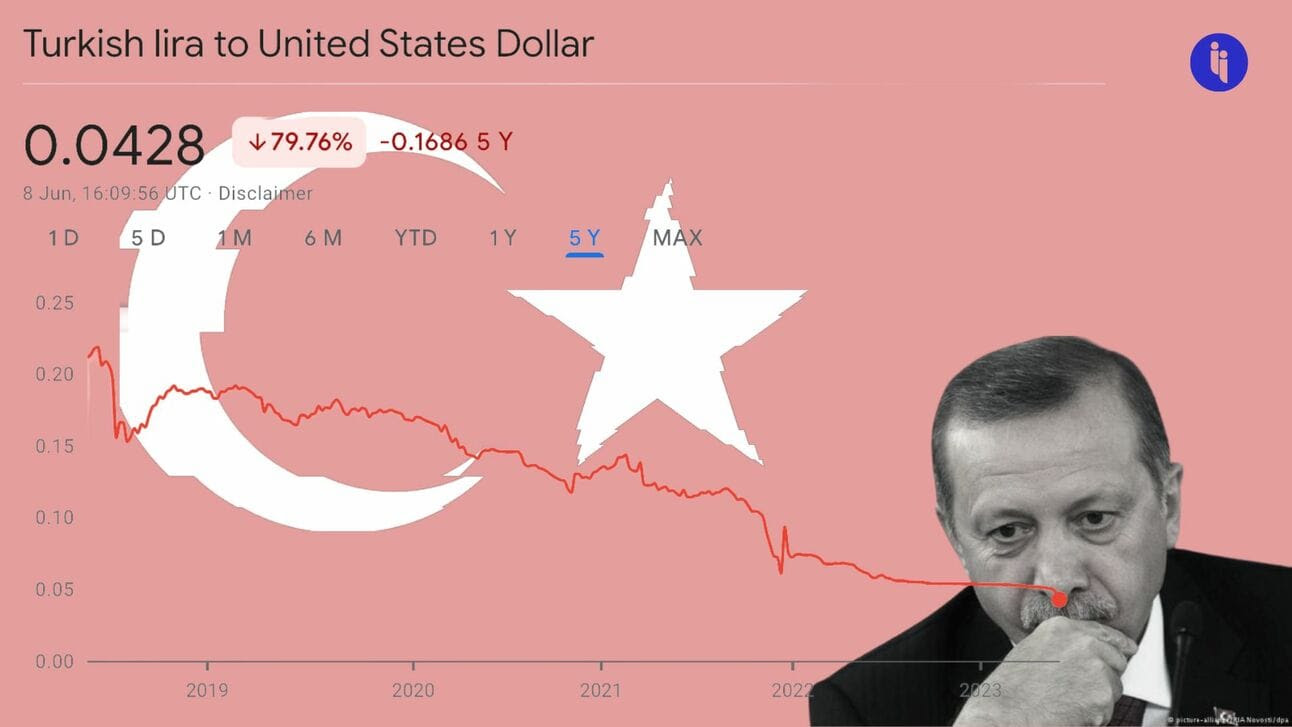

Briefly: The Turkish lira slipped by more than 7% against the US dollar on Wednesday, hitting a record new low.

The slide comes as Turkey’s newly appointed finance minister, Mehmet Simsek, pledged to return the country’s economy to more “rational ground”.

And you don’t need to read between the lines here. You can just read the lines. Simsek was criticising Erdoğan’s economic management as being irrational:

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 114,000+ subscribers

No spam. No noise. Unsubscribe any time.

- Erdoğan frequently intervened to try and prop up the lira, and

- He said lower interest rates reduce inflation (the opposite is true)

The result?

- ☝️ Sky high inflation, peaking at 86% last year

- 👇 A weak currency, losing 60% of its value since 2021, and

- 😨 Spooked investors, who now hold <1% of Turkey’s bonds (they held 19% in 2017)

So… if we’re returning to rationality, why has the lira now plunged even faster?

Before his re-election, Erdoğan was burning through reserves to prop up the lira (to avoid voters seeing this exact collapse). But the central bank’s coffers are now basically empty. So the currency’s prop is now gone. And the market is speaking.

Intrigue’s take:Rebuilding the Turkish economy is a daunting task, but this isn’t Simsek’s first rodeo. He’s a highly regarded ex-banker who was instrumental (as finance minister) in helping Turkey rebound from the 2008 financial crisis.

But to do that again, he’ll need Erdoğan to hand over the reins. And that’s not really Erdoğan’s style.

Also worth noting:

- During his re-election campaign, Erdoğan promised he would keep cutting interest rates if reconfirmed as president.

- Erdoğan has overhauled several other key cabinet roles in an apparent effort to help normalise Turkey’s economic and foreign policies.