The World Economic Forum (WEF) crams epic wealth and power into the tiny Swiss ski resort of Davos each January, leaving it open to some truly cracking conspiracy theories — personally as Simpsons fans, we love to imagine Davos rigging every Oscars night.

But we’ve been to Davos before (and will be back again from Monday), so can confirm that yes, while the suits are expensive, the substance typically isn’t so spicy.

Anyway, like every other international body, WEF dutifully produces dense reports, like its latest WEF 2025 Global Risks Report. This particular 100-page beauty smells of rich mahogany and is based on a survey of 900 leaders across academia, business, government, diplomacy, and civil society — and that’s interesting to us because knowing how our leaders see things can help us understand and anticipate their next move.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 129,000+ subscribers

No spam. No noise. Unsubscribe any time.

So… here are our top five quotes from this year’s WEF Global Risks Report:

- “Perceptions of the overall economic outlook for 2025 remain fairly pessimistic across all age groups surveyed”

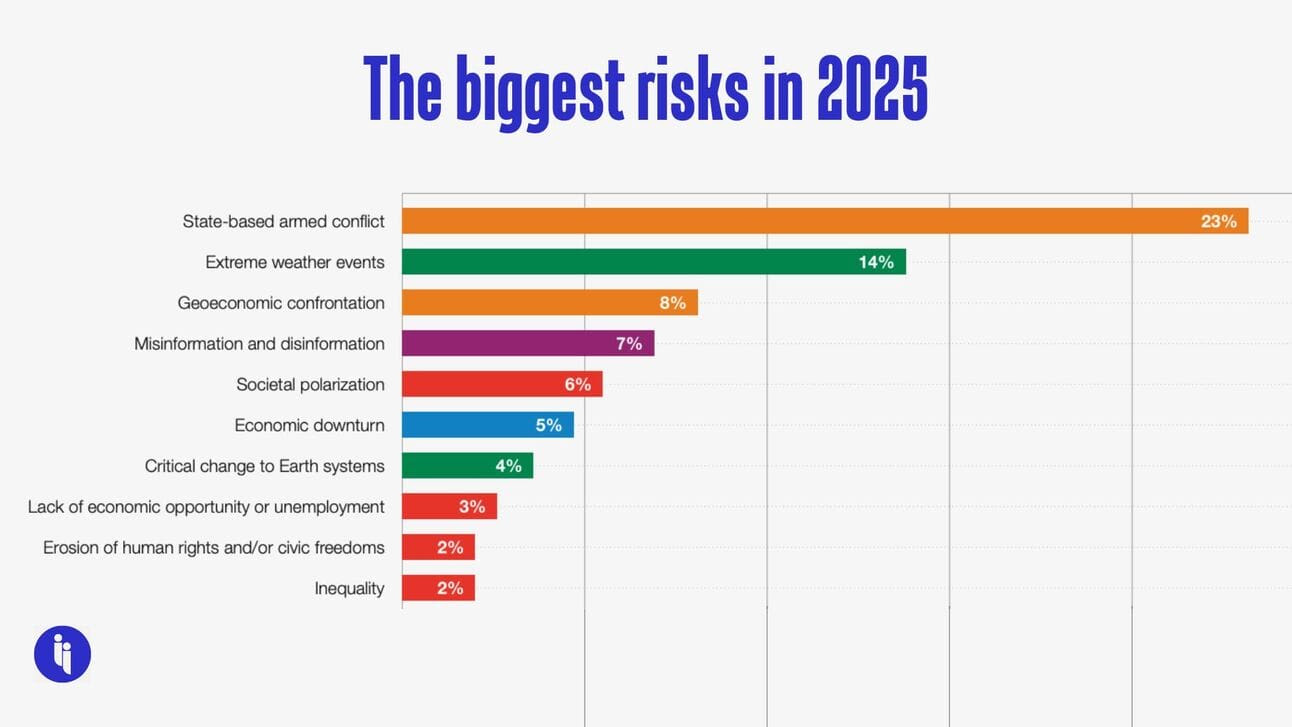

In this polarised day and age, it’s nice to finally agree on something, right? Except this: 2025 looks bumpy, with economic issues still taking four of the top ten risks for 2025.

Interestingly, inflation has now disappeared from the top ten (it’s now #29), but geoeconomic confrontation has shot up to #3, right after armed conflict and extreme weather events.

Meanwhile, respondents also cite risks of an economic downturn and a lack of economic opportunity this year, but there’s some good news, too:

- Over a longer time horizon (two and 10 years), leaders see these risks subsiding, with only debt and asset bubble risks lingering, and maybe more importantly…

- Projections are often wrong! Remember 2022? That’s when various models were citing a 100% probability of a US recession within 12 months.

- “A loss of support for and faith in the role of international organizations in conflict prevention and resolution has opened the door to more unilateralist moves”

As global challenges grow in number and complexity, folks are losing their faith in the ability of institutions to deliver answers.

That’s partly why so many capitals are now charting their own course instead, often with cheers from their voters. And sure, some of the world’s most popular leaders are now the ones most laser-focused on the basics back home.

But to the extent this shift weakens cooperation abroad, it’s the type of thing we’ll miss once it’s gone — treaties are what helped us shrink the ozone hole, de-risk international aviation, and reduce the chance of smaller countries getting screwed by their neighbours.

- “Deeper decoupling of trade between West and East would have worldwide repercussions”

While the US and China are pulling up their drawbridge in specific sectors (AI, chips, critical minerals etc), there’s debate around the extent to which a broader decoupling is even playing out yet: China hit a record trillion-dollar trade surplus last year, and the US trade deficit is now rising again after peaking in 2022. So while US-China trade specifically has eased, the same basic global imbalance persists (just with a few more intermediaries).

But the basic point here holds true: whatever the aggregate figures say, businesses are feeling the risk of rugs getting pulled — tariffs, export controls, state subsidies, and investment screening can now hit suddenly, with tangible, billion-dollar implications.

That raises the cost of doing business, and makes investors think twice.

- “Pension crises will start to bite over the next decade in super-ageing societies”

The term “super-ageing societies” is interesting — that’s when over 20% of the population is over 65 years of age. Countries like Japan, Germany, France, and Portugal are already there, with more to follow — global over-65s are projected to grow 36% by 2035.

And as that proportion of pension-aged people increases, governments face bigger spending and labour shortages, plus tighter tax revenues and health resources.

Sure, there are solutions, but none are easy: you could delay the retirement age and risk riots (ask France); try to get citizens to have more children and risk ridicule (ask South Korea); or raise migration and risk a housing crisis (ask Canada and others).

- “Environmental risks have consistently topped the 10-year ranking”

While immediate risks tend to fluctuate, environmental risks have long topped the long-term risk list (say that ten times fast. Or not. We’re not going to tell you what to do).

That’s interesting given climate concerns have quietly dropped down the government to-do lists lately. It probably points to some kind of mismatch, whether between the urgent and the important, or between the sentiment at Davos and everywhere else.

Anyway, the general vibe of this year’s WEF Risks Report is gloomy, pointing to a world that’s less secure, less stable, and less prosperous.

INTRIGUE’S TAKE

But yes, dear Intriguer, we’re going to leave you with some positive vibes: first, just remember that gloomy vibes are the entire point of a risk report. If we spent an entire year on a report, and came back with a single page noting that, you know what? It all looks pretty good out there, boss. Nothing to worry about… Yep, we’d be out of a job.

But second, it’s also partly the point of Intrigue: when still working on the inside, we often noticed that the public debate was catastrophising some issues more than what the facts justified. Sometimes that’s because media outlets use fear and outrage to drive clicks and revenue. We prefer memes instead (see below).

Also worth noting:

- Lest you think we’re being dismissive about any of the risks above, take a trip with us back to 2006, and you’ll see the WEF Risks Report that year cited the possibility of oil shocks, climate change, terrorism, and a pandemic.