India’s two-day summit of G20 leaders wrapped up yesterday (Sunday).

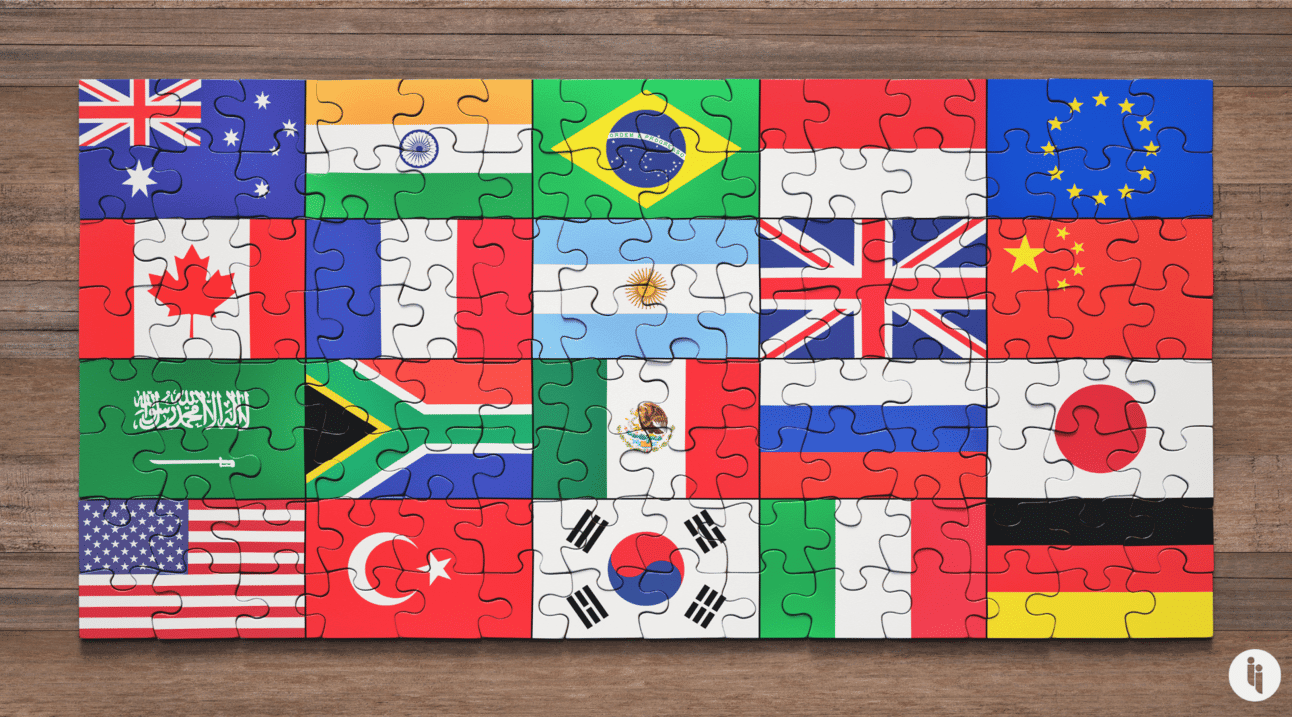

What’s the G20? It’s a group of 20 ‘major’ economies, but not the 20 largest: e.g., it includes both South Africa (ranked #39) and Argentina (#23).

The list of members was developed in the 1990s by mid-ranking US official Timothy Geithner (who later became US treasury secretary). He wanted a mix of key advanced and emerging economies, to better coordinate policy.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 99,000+ subscribers

No spam. No noise. Unsubscribe any time.

So the G20 remained a niche finance bloc until 2008, when the US upgraded it to an annual summit of leaders during the global financial crisis (GFC).

What happened this weekend in India? To the surprise of many, G20 members (including Russia) managed to agree on a declaration, including:

- 🏦 Calling (in broad terms) for bigger and better multilateral banks

- 🌍 Welcoming the African Union as a G20 member (it was already attending every summit as an invitee), and

- 🇺🇦 Highlighting the suffering from the “war in Ukraine” (the text lists Russia as a source of grain, but not as the source of the invasion…)

The no-show by China’s leader was also intriguing. There were likely various factors at play, but China’s spoiler role at the summit suggests sheer rivalry was a key consideration. E.g., China tried (unsuccessfully) to:

- 📖 Cut a Sanskrit term from the G20 declaration, likely seeing India’s phrase (meaning “the world is one family”) as rivalling China’s own vision for “a community of shared future for mankind”, and

- 🙅 It also tried to oppose any mention of the US hosting in 2026.

Intrigue’s take: In diplomacy, there’s often a trade-off between legitimacy and effectiveness: adding another voice brings legitimacy (representing more people), but it cuts effectiveness (there are more competing interests).

The G20 was supposed to be the sweet spot: with a manageable 20 voices, yet covering 85% of the world’s GDP and two thirds of its population.

But with the GFC in the rear-view, the G20 became a solution in search of a problem, expanding its agenda in search of purpose: its declaration this year is 15,000 words long (quadruple the 2008 statement).

Like all international bodies, the G20 is under pressure. And by most accounts, India was a solid host. But the big picture is the same: the G20 seems adrift, made worse by big power rivalry.

Also worth noting:

- The G20’s final text on Ukraine reportedly involved “over 200 hours of non-stop negotiations, 300 bilateral meetings (and) 15 drafts“.

- G20 members also made announcements in the margins, including a US-led trade corridor from India to Europe through the Middle East; and an India-led pact on biofuels. Neither involved China.

- Brazil will host the G20 next year, followed by South Africa in 2025 and the US in 2026.