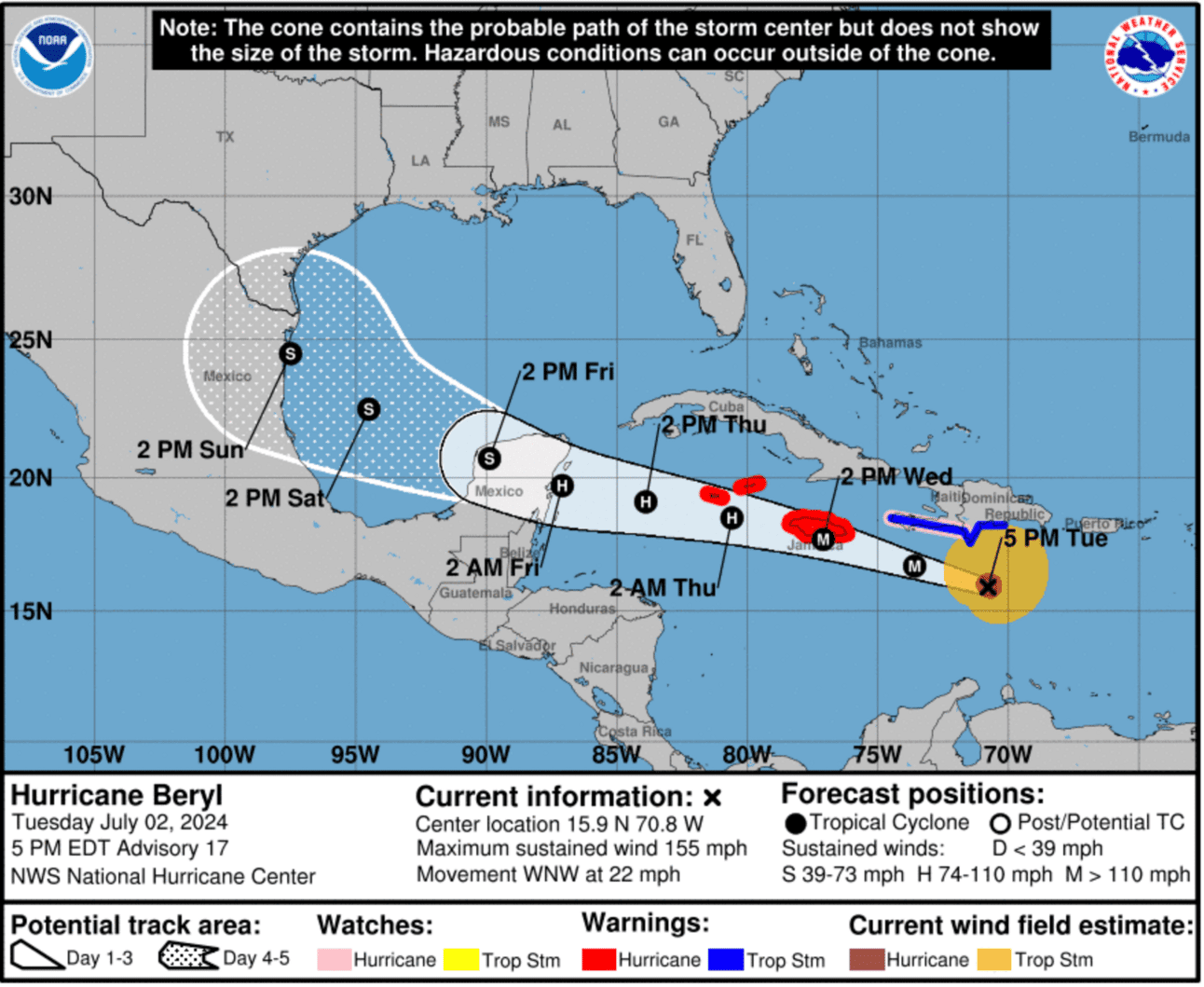

With winds reaching 165 mph, Hurricane Beryl made landfall in Grenada and St Vincent on Monday and was upgraded to a Category 5 storm yesterday. 5 is the highest rating on the Saffir-Simpson Hurricane Wind Scale, which is used to estimate potential property damage.

Hurricane Beryl has already killed at least three people and caused substantial damage to buildings and communication lines. Grenadian Prime Minister Dickon Mitchell stated: “In half an hour, Carriacou [an island in Grenada] was flattened.”

A severe hurricane warning has been issued for Jamaica and the Cayman Islands today (Wednesday), which is “expected to bring life-threatening winds and storm surge” to the islands. Current forecasts suggest Haiti and southern Mexico are also in Beryl’s path.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 114,000+ subscribers

No spam. No noise. Unsubscribe any time.

The storm is now the earliest ever-recorded Category 5 storm to form in the Atlantic, raising concerns about the destructiveness of this year’s hurricane season. Scientists believe hurricanes will become slower and more intense as the planet and its seas continue to warm.

Wait, why are we telling you about a hurricane?

Because economists at the World Bank and the governments of Jamaica, the Cayman Islands and Mexico have a financial stake in Beryl’s behaviour via a financial product known as ‘catastrophe bonds’ (aka cat bonds).

A cat bond allows governments and insurers to transfer the risk of extreme weather events to investors, ensuring they’ll have the money to meet expected claims.

For investors, cat bonds represent a high-risk, high-reward strategy: a mild storm season will net them a tidy return, but a storm like Beryl could lump them with significant losses.

In April, before the Caribbean storm season, the World Bank issued over $745M of cat bonds for Jamaica and Mexico. Hurricane Beryl is threatening to trigger those countries’ payment clauses.

More broadly, cat bonds are having a moment:

- They were the best-performing asset class of 2023, with an impressive 20% return for asset holders (outperforming hedge funds)

- A record $12.6 billion were issued in the first half of 2024

- The cat bond market is now worth ~$48B, more than twice its 2013 valuation.

2023 was particularly lucrative for bondholders as it was a relatively quiet year for natural disasters. But this year, financial analysts are signalling caution, and Beryl’s early and unwelcome appearance suggests they might be right.

INTRIGUE’S TAKE

The ‘Loss and Damage Fund’ agreed at COP28 last December was hailed as a political breakthrough, although plenty of experts are sceptical that developed countries (historically the biggest polluters) will actually stick to their funding commitments.

Cat bonds for climate-related events like storms, floods, droughts, and heatwaves could help provide a more suitable and enforceable (if more costly) way to help regions disproportionately affected by climate change receive financial compensation.

At the considerable risk of sounding too much like Ayn Rand, might financial innovation and the free market be a more productive method of mitigating the cost of climate change than trying to convince rich governments to give money to poorer ones?

Also worth noting:

- The World Bank has issued a total of $4.8B in cat bonds since it first started dealing in them in 2006.

- There’s troubling (if incomplete) evidence that climate change increases social, political, and geopolitical risk over the medium to long term.