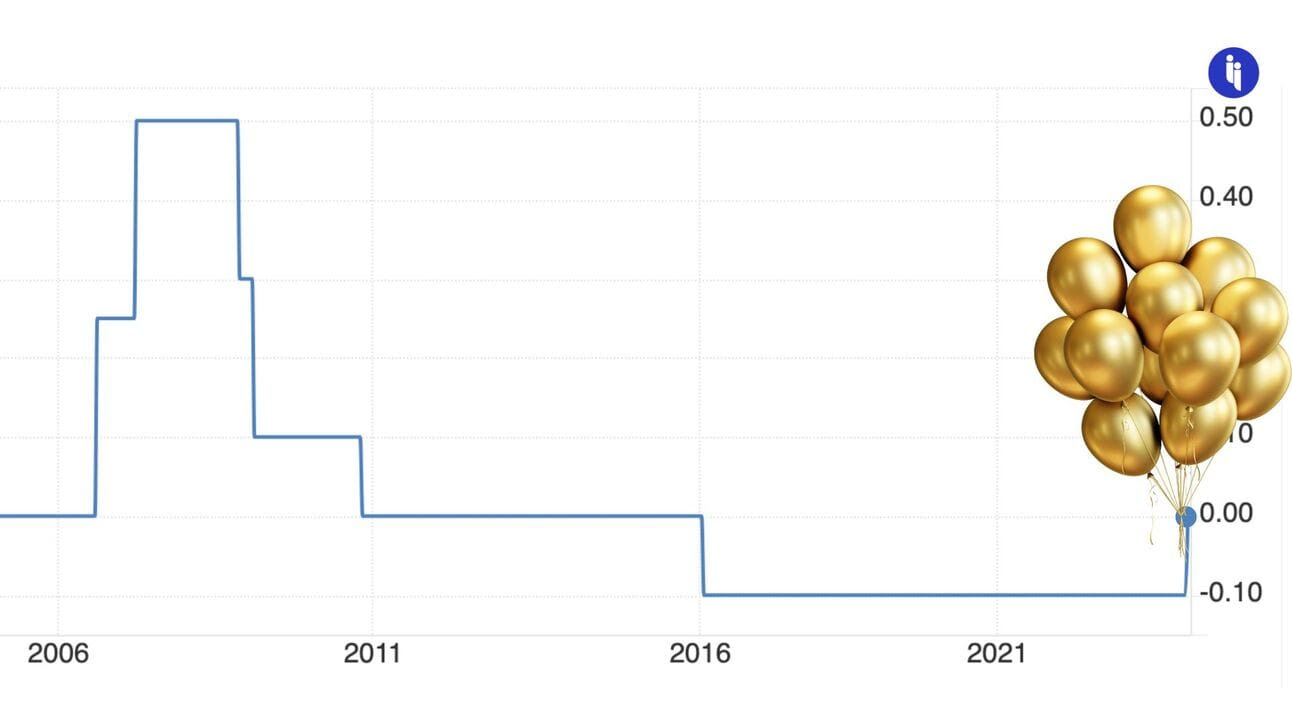

The Bank of Japan (BOJ) has announced it’s hiking interest rates from -0.1% to a 0-0.1% range, bringing to an end the world’s last negative rate regime. The move, which was widely expected, is Japan’s first interest rate hike since 2007.

Japan has long been an outlier here among advanced economies. While many of us have watched rates rise as central banks try to curb inflation, Japan has struggled with the opposite problem (deflation) since its epic property bubble burst in the 1990s. And we’ve written before about the mysterious forces of deflation, which are associated with all kinds of economic malaise.

So to try and ‘re-flate’ its economy, Japan has mostly had ultra-low rates since the 90s, and was the first to drive rates negative in 2016.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 145,000+ subscribers

No spam. No noise. Unsubscribe any time.

When rates go negative, you can end up paying a bank to look after your cash, rather than you earning interest on your savings. And for borrowers, it means paying near-zero interest on loans. So the challenge (and the whole point) becomes finding something productive to do with all this cash, rather than leaving it to wither in a Japanese bank account.

The result? Japanese money has headed overseas, making Japan the world’s largest net lender for 31 years straight, while its investors have hoovered up assets everywhere, from skyscrapers in Manhattan to breweries in Australia.

So, why act now? Rumours of an impending rate hike have been circulating for months, as Japan’s inflation rate has remained above the BOJ’s 2% target since April 2022. But the speculation really started to heat up in recent days.

Just last week, the country’s biggest companies agreed to increase wages by ~5.28% in 2024, the largest pay rise in 33 years (and way more than expected). This should, in theory, lead to households spending more, driving a virtuous cycle to further re-flate the economy, and eliminating the need for negative rates.

And the BOJ’s decision earlier today (Tuesday) shows it shares that assessment. So here’s what higher rates could now mean for Japan and beyond:

- It’ll be costly for the government, which will have to start paying higher interest on its debt (Japan has the highest debt-to-GDP ratio among advanced economies, at around 252%)

- It’ll be costly for the BOJ too, because higher rates bring lower bond prices, and the BOJ holds more than half of Japan’s government bonds (though it’s not evident this would pose significant problems for a central bank that’s printing and lending in its own currency)

- If rates keep rising, Japanese cash abroad could start to return home, strengthening the yen against the US dollar – this would make Japan’s exports less competitive and its imports (like energy) cheaper, while potentially weakening asset prices abroad as Japan’s investors sell up

- And Japan’s private banks should see their profits increase as they can finally lend at positive rates again, but on the flip side…

- The price of mortgages (70% of which are linked to the BOJ’s floating rates) should increase slightly in the medium-term, curbing the enthusiasm of those households enjoying newly fattened pay cheques.

So while in purely numerical terms today’s hike is pretty slim, it signals the end of an era. And that has the potential for some far-reaching and unpredictable ripples.

INTRIGUE’S TAKE

Last year’s appointment of Japan’s central bank chief, Kazuo Ueda, caught everyone by surprise, and even drove his 2005 memoirs (with the catchy title of ‘Fighting Zero Interest Rates’) to suddenly become a hot item. Why? Nobody expected modern Japan to appoint its first academic economist to such a messy role.

But Ueda seems to have been preparing his whole professional life for precisely this moment: check out the speech he gave in 1999, shortly after he first joined the central bank’s policy board. It’s a good read, partly because it includes a self-effacing economist joke in the opening paragraph.

But also because it closes with a lesson that Japan then spent the next quarter of a century re-learning: “do not put yourself into the position of zero rates. I tell you it will be a lot more painful than you can possibly imagine”.

So it only feels fitting for Ueda to be at the helm as Japan now steers its way back out.

Also worth noting:

- While slightly raising rates today, the BOJ also said it’ll continue buying government bonds and maintain accommodative financial conditions.

- Japan narrowly avoided a technical recession (two consecutive quarters of negative growth) after revising its official data for the final three months of 2023.

- As our friends at Lykeion point out, Japan’s three rate rise cycles since the 1980s have each occurred ahead of a US recession.