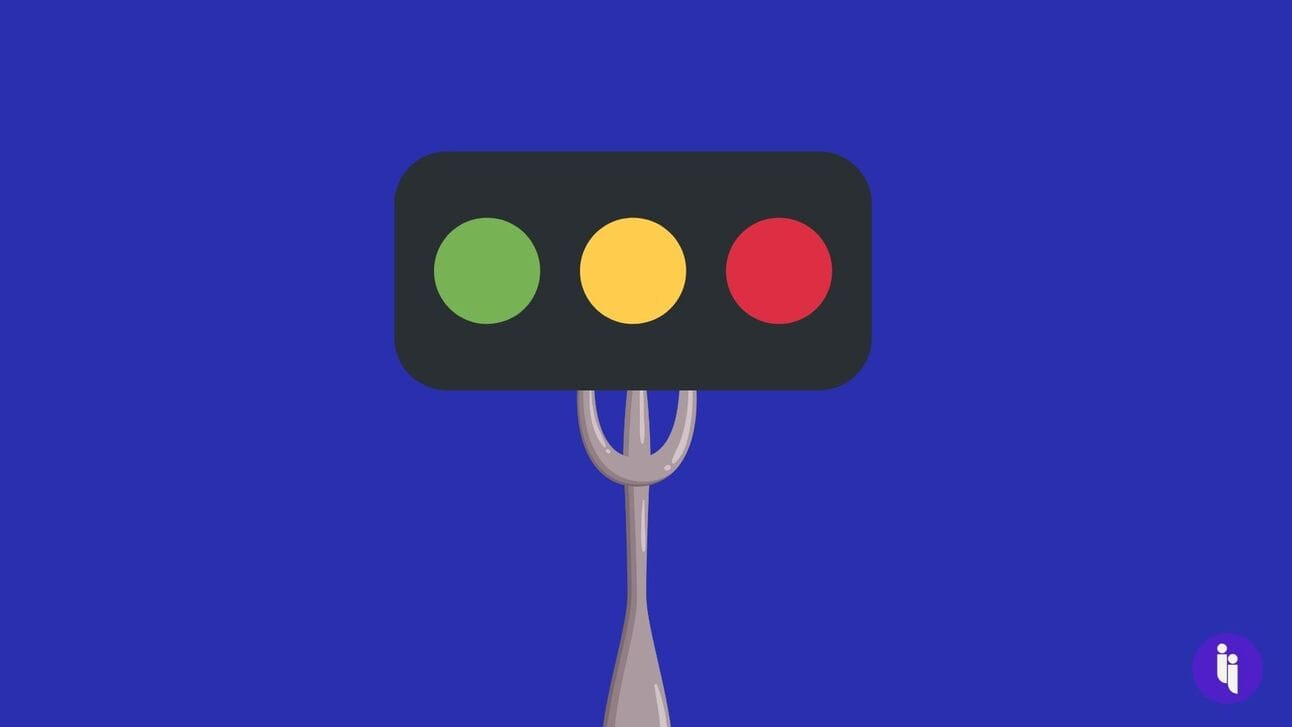

Remember group projects? Everyone’s there, technically working together, but barely clicking on the same Google doc tab? Just awful. But that’s exactly what Germany opted for with its ‘traffic light’ coalition government between three parties back in 2021.

And why did that coalition just collapse? Three reasons.

First, the coalition itself was an uneasy arrangement. The main characters included:

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 145,000+ subscribers

No spam. No noise. Unsubscribe any time.

- 🔴 Chancellor Olaf Scholz of the centre-left Social Democrats (SPD), the diligent overachiever who seized power after Angela Merkel retired in 2021

- 🟡 Finance Minister Christian Lindner of the business-friendly Free Democrats (FDP), the young and ambitious gun who’s tight with the purse-strings but loves the limelight, and

- 🟢 Foreign Minister Annalena Baerbock of the Greens, the rising star now strutting the global stage as chief diplomat after overcoming a plagiarism scandal.

Now, for anyone still stuck in two-party US politics, welcome to Berlin, where various parties must form coalitions to survive in the Bundestag. That’s how you end up with such an unlikely trio as the one above: different visions demanding different priorities.

Second, the job itself is tough and getting tougher. The DAX (a blue-chip German stock index) offers a few data points just over the last year:

- 🏗️ Steel titan Thyssenkrupp is lowering profit forecasts while it’s engulfed in a leadership crisis

- 🚗 Automakers Volkswagen and BMWare facing weak demand and steep competition from China, with VW sounding the alarm on historic layoffs

- 🛞 Tire giant Continental is now looking to sell business units to help balance its books, and

- 🚢 Shipyard Meyer Werft just snagged a last-minute government bailout to avoid bankruptcy.

These are different firms with different issues, but they all point to Germany’s core challenge: its manufacture + export business model is under pressure from greater competition abroad (China) and declining productivity at home (exacerbated by the Russia-induced energy squeeze).

Add Russia’s war on Europe’s doorstep, plus the US electing a Euro-and-NATO-sceptic president with a penchant for tariffs, and that’s a messy in-tray for any government, let alone a messy ‘traffic light’ government like the one above. Which leads us to…

Third, we are morally and legally obliged to use one random German word whenever discussing Germany, and today’s word is ‘Schuldenbremse’, or debt brake. Germans enshrined it in the constitution 15 years ago, limiting deficits to 0.35% of GDP.

Its backers (like the spendthrift Finance Minister Lindner) see this brake as sacrosanct, curbing inflation and keeping Germany’s finances in shape. Its detractors (increasingly including Chancellor Scholz) argue the brake prevents Germany from responding to crises and investing in its future.

That division has been bubbling away within the coalition but exploded into public view over the past week, culminating in Scholz firing Lindner last night (Wednesday). Which leads us to…

Fourth, the timing. Why now?

On current polling, Lindner’s party wouldn’t even have a place in parliament after next year’s elections, so he might’ve pushed things to a head now in hopes of getting a role in whatever coalition comes next (the main opposition bloc is actually his traditional partner).

There was also a sense maybe Trump’s return might force more unity within Germany’s coalition, but instead, the pressure just cracked it. Germany is now bracing itself to shoulder more of the burden if Trump hits pause on US support for Ukraine. For Germany, that requires more cash, which goes to the heart of the Schuldenbremse debate above.

So, what next? Scholz says he’ll continue to run the show with his other coalition partner (the Greens) in a minority government, cobbling together parliamentary majorities to pass laws as needed until January 15. That’s when he’ll call a parliamentary confidence vote on his government.Depending on what happens, there might then be snap elections in March (six months earlier than scheduled).

It’s a risky bet for Scholz, with an 18% approval rating and populist parties on the left (BSW) and right (AfD) nipping at his heels.

INTRIGUE’S TAKE

The EU has three times Russia’s population and ten times its GDP. If it wanted to shape Putin’s war more in its own favour, it probably could. But that takes time and will, both of which seem limited right now.

On time, Europe has now had three years, if you wanted to start the clock at Putin’s full-scale invasion; or ten years if you wanted to start at Crimea; or 16 years if you wanted to start back at Putin’s invasion of Georgia. But while improving, its security posture still doesn’t come close to matching its economic and demographic heft.

And then on will, just as the US potentially begins pulling back its own support, there are signs the EU’s largest economy by far (Germany) is now turning inwards, not just to manage this latest political impasse above, but also to (for example) block an Italian takeover of a German bank, or deploy more checks at Germany’s borders.

Of course, it’s not all one way — Germany is also deploying more troops to fellow EU and NATO member Lithuania, for instance. And nor is Germany alone — other EU members have shown similar signs of an inward turn. But whatever it is, it doesn’t seem enough for what Germany – and Europe – now confront.

Also worth noting:

- Germany has taken in more than a million refugees from Ukraine since February 2022, costing a reported $21B in accommodation and integration services. Germany is also Ukraine’s #2 backer after the US.

- If you’re wondering what Angela Merkel is up to these days, she has a memoir coming out on November 26 — Freedom: Memories 1954-2021. Say what you like about Merkel, but she always had impeccable timing.