We’ve been writing about bonds before they were the flavour of the week. And events now dictate that we revisit bonds again. Who are we to argue with events, dear Intriguer?

Typically if US stocks tank, spooked investors will shift their cash over into bonds — the ultimate safe-haven. Why? When you buy bonds (loan the US government money), you’re trusting Uncle Sam will pay you back with interest. It’s a safe bet because it all rests on:

- a) The world’s largest military

- b) The world’s oldest modern democracy, and

- c) The world’s deepest, most liquid market (the $29T market for US treasuries).

Uncle Sam could even repay you with dollar bills printed out of thin air if he wanted — all part of what Valéry Giscard d’Estaing famously described as the “exorbitant privilege” of having the world’s reserve currency (though there’s a fierce and nerdy debate there).

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 129,000+ subscribers

No spam. No noise. Unsubscribe any time.

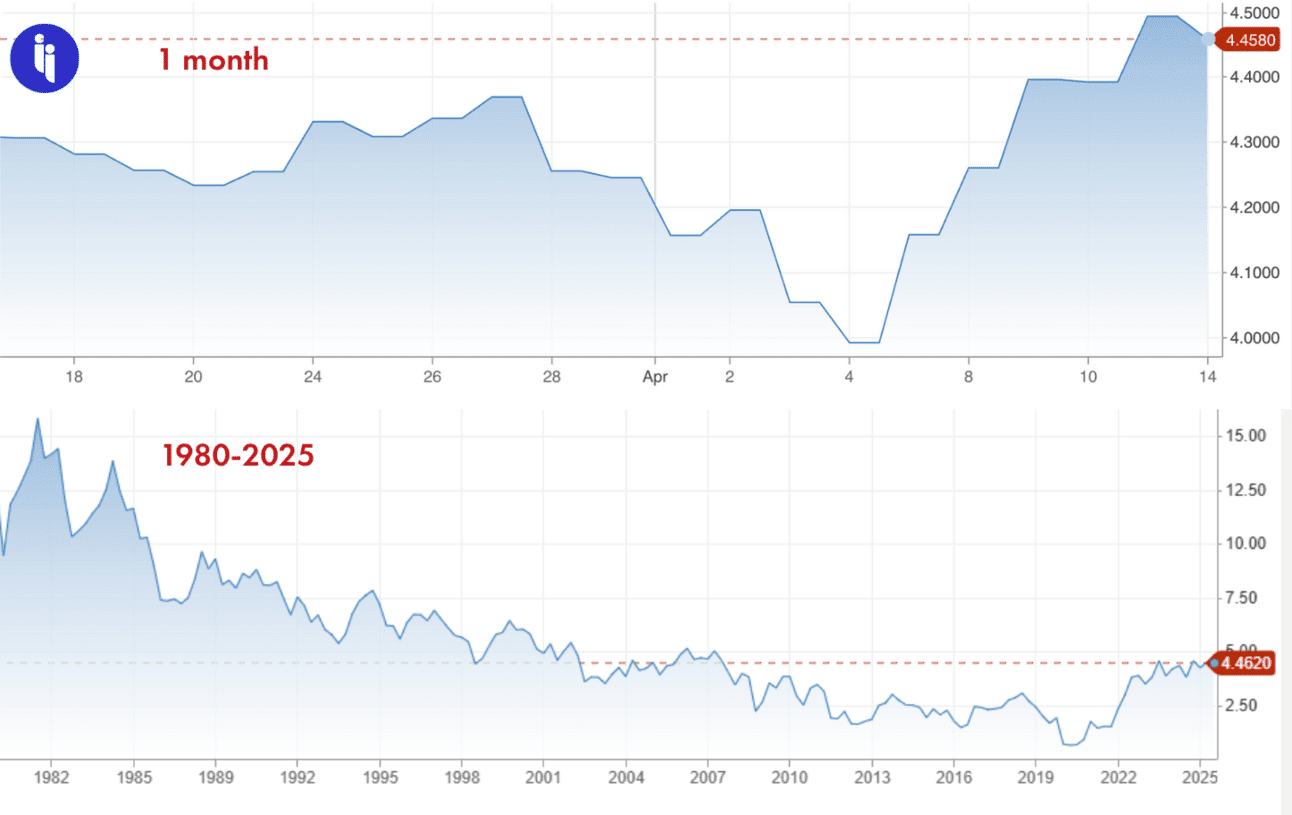

But since Trump’s big liberation day tariff reveal and partial walk-back, something weird has happened: investors have not only been selling US stocks, but also US bonds, and even the US dollar. It suggests folks aren’t just doing the usual cyclical rotation from one US asset class to another, but are actually moving their cash out of US assets altogether.

So what’s going on?

Trump’s supporters variously argue:

- It’s just a temporary market spasm

- It’s just a reversion to the mean (eg, bond yields are the same as a year ago)

- It’s Biden‘s fault (yields have been rising as US debt grows), and/or

- It’s just part of the plan: when you use tariffs to block imports from China and unwind America’s trade deficit, your trade partners no longer accumulate dollars, naturally leading to weaker demand for US bonds and other US assets.

But markets are pricing in other theories you should know about, including…

- ‘The triple yasu’

This is not a delicate gym routine or a tasty three-layered tempura. Rather, Japan’s Nikkei newspaper used the term ‘triple yasu’ last week in a throw-back to Tokyo’s own 1990s experience when investors pulled the same triple sell-off: stocks, bonds, and the yen.

For a major Japanese financial paper (the world’s biggest) to lob that term at the US is remarkable to the extent they’re implying (and they are) that investors have doubts about America’s trajectory. Why? Some market players now partly blame…

- ‘The moron premium’

To be clear, we’re not calling anyone a moron. Rather, this brutal diss was coined by a London macro analyst to describe the fact that, even after former UK leader Liz Truss reversed her disastrous 2022 UK mini-budget, fired her finance minister, and then got fired herself, investors are still demanding higher interest to loan the UK money. Why?

You can hit ctrl-z on a mistake, but you can’t force markets to forget the fact you made it.

And the argument here is that even though Trump has now partly hit ctrl-z, he can’t pull some Obi-Wan trick to make the markets forget (“these aren’t the yields you’re looking for“). Markets, who don’t care about left or right, or MAGA or pronouns, are calculating that if he shocked us once (the biggest tariffs in a century), he might shock us again.

So does any of this matter?

Unless we see US yields drop again (entirely possible), we’ll all feel the impacts:

- US bonds are linked to US mortgages and other household and business debt, so any higher borrowing costs risk washing over US families and firms, plus

- The US is due to refinance $6T in debt this June — if that auction locks in higher rates, it’ll mean tougher spending and tax choices for the US government ahead (tariff revenues won’t close the gap).

Oh, and lest you Intriguers abroad think this is just a US problem, remember that higher borrowing costs in the US can flow through to just about everywhere else.

INTRIGUE’S TAKE

There’s lots of breathlessness around all this, sometimes for valid reasons (America copping a triple yasu is weird). But it’s also worth taking a deep breath and recalling there’s still no market anywhere near as deep and liquid as US treasuries. And there’s no currency anywhere near as dominant as the US dollar.

But still, there’s evidence the last week of market chaos has gnawed away at both US pillars. And that’ll accelerate the world’s thirst for viable alternatives over the years ahead, if only to hedge risk. Spooked capitals spook capital.

Also worth noting:

- Most US bond-holders are actually in the US (pension funds, social security, the Fed etc). Outside the US, the biggest holders of US debt are Japan ($1080B), China ($760B), and the UK ($740B).

- US government interest payments on debt are now the third-largest budget line item ($882B) after social security ($1.5T) and healthcare ($912B).