In amongst all the other headlines, it’s easy to miss what’s happening right now in a critical sector (metals) across a fast-moving region (Latin America).

Many of the region’s key miners, including Peru and Chile, are banking on a big 2024.

Chile – the world’s top copper producer and second-biggest lithium producer – is projecting stronger production this year. It’s hoping lower US interest rates, a recovery in China, and continued electrification will drive global demand.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 134,000+ subscribers

No spam. No noise. Unsubscribe any time.

Meanwhile, Peru – the world’s second-top copper producer and third-biggest silver producer – pulled off a major year-on-year production increase (🇵🇪) in six of its eight main metals last year. It’s projecting more of the same, partly due to the demand factors above, but also as it rebounds from unrest in 2022-23.

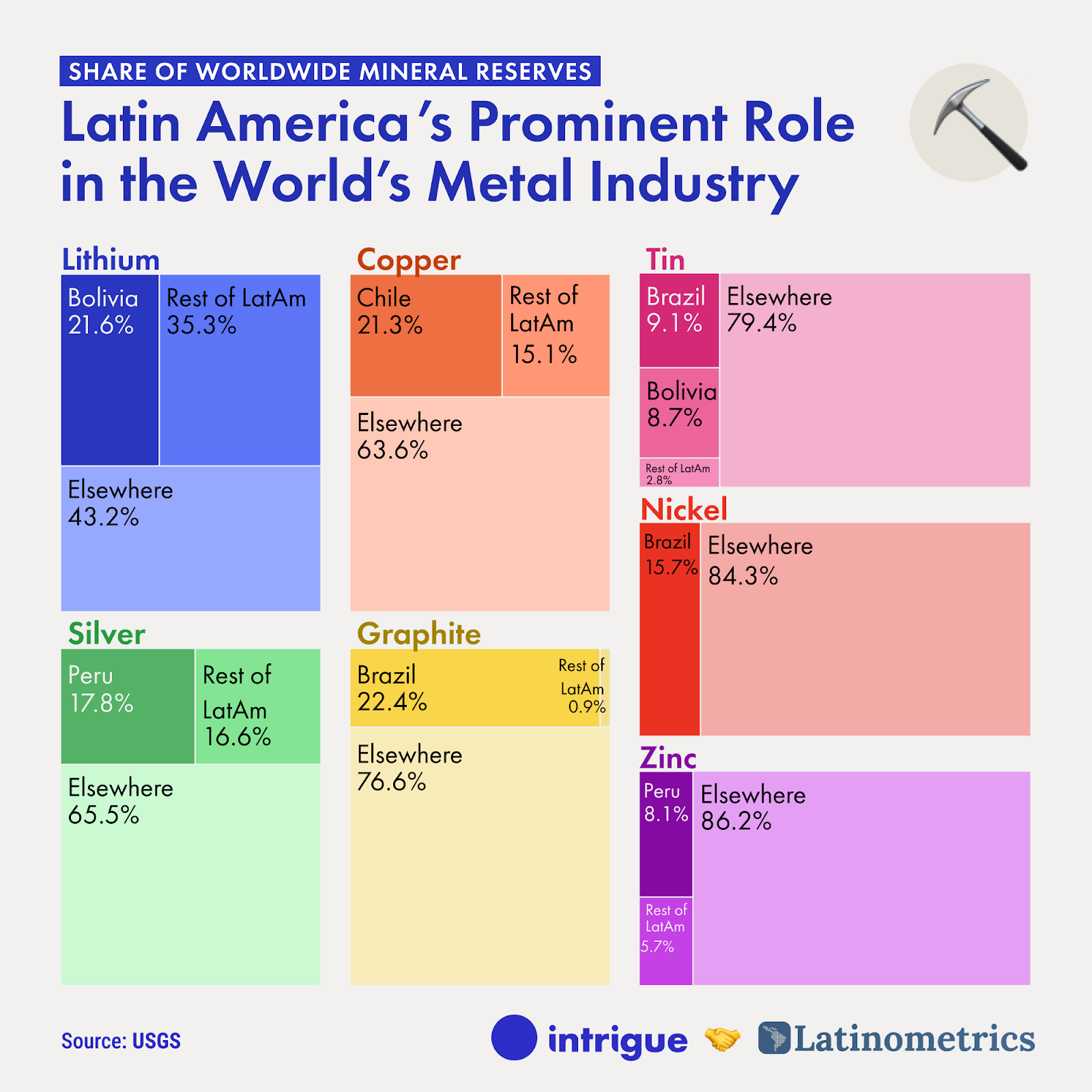

It’s a similar story for much of the region, which is sitting on 57% of the world’s lithium, 39% of the world’s copper, and a third of the world’s silver.

In fact, several long-term trends are now working in Latin America’s favour:

- The energy transition – As the world buys more EVs, solar panels, and batteries, it’s driving demand for inputs like copper, lithium and silver.

- Geopolitical tensions – US-China rivalry means governments are scrambling to secure key metals to protect vital industries like automotive and green energy; plus, Latin America also ranks well for investors looking to lower their geopolitical risk exposure.

- Predisposition – In addition, 21 out of Latin America’s 33 countries can already credit commodities for over half their export revenues, meaning they’re already set up to seize any mining boom.

But of course, sitting on a gold mine has its challenges:

- Environmental and social – Peru, Chile, Panama, and others have seen widespread mining protests, reflecting anger around the impact on ecosystems and local communities, plus how the spoils are being divided.

- Market volatility – Lithium prices have now collapsed by a stunning 80% from their 2022 peak, and metal prices more broadly are projected to drop by 3% this year, mostly due to big increases in supply. These fluctuations pose a real risk for a region so dependent on commodities.

- Security – Illegal mining is causing headaches in places like Brazil, Colombia, Peru, and Venezuela. And it’s a tough one – up to 90% of Venezuela’s gold exports (and half of Brazil’s) may come from illegal mines, which employ hundreds of thousands of folks across the Americas and enrich various armed groups. Some governments have deployed troops in response, while Venezuela’s military itself is involved in illegal mining.

- Resource nationalism – More governments in the region are now seeking more control over their resources, partly in response to the above factors. This spooks international investors who worry about waking up to a headline that their mine just got yoinked, though not all models are the same: Chile’s new National Lithium Strategy increases the state’s role without seizing private assets, earning an okay review by Fitch Ratings.

On paper, Latin America is an economist’s dream: resource-rich, young, entrepreneurial, mostly stable, and with direct shipping routes to the world’s two largest economies. In practice though, it’s not always been easy.

At its core, there are some tricky philosophical, political, and ideological questions about how a society should best manage its resources. And Latin America has long wrestled with those questions in some spectacular ways: the region’s flood of gold once collapsed prices so hard, it bankrupted Spain’s monarchy three times in the first century after colonisation.

Ultimately, there’s no one-size-fits-all approach, and the world has seen countries prosper without any extractive industries (hi Singapore 👋).

But looking ahead – to the extent Latin America can sustainably balance the expectations of investors, workers, and communities, it’ll be sitting pretty.

Also worth noting:

- Latin America was hit hard by Covid-19, with annual GDP growth dropping from 7.3% in 2021 to an estimated 2.3% this year.

- Thanks to our friends at Latinometrics for partnering with us on this piece – check out their awesome work here.