Not many companies can issue a recall on their latest product, lay off 10% of their workforce, report a 9% drop in revenue, and still somehow ride a 13% bump in share price. But that’s what US EV-maker Tesla has just done.

It’s been a rough year for Tesla. Its share price dropped 42% between January and Tuesday’s market close, making it the worst performer in the S&P 500.

So there was a lot of interest in Tuesday evening’s quarterly Tesla earnings update, which delivered even more grim news: profits halved, and deliveries dropped for the first time in four years, despite price cuts to stimulate demand.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 148,000+ subscribers

No spam. No noise. Unsubscribe any time.

So then, why did Tesla’s stock still rally?

Investing is partly about seeking a slice of the future, and CEO Elon Musk made a few comments during Tesla’s investor call that restored hope (for some):

- After Reuters reported (and Musk denied) Tesla had canned plans for a cheaper new model at $25k, Musk said the company is now fast-tracking plans for a “more affordable” car, though the specs are TBC.

- He also reiterated his vision for Tesla as an AI, automation and energy player, while teasing details about his ‘Cybercab‘ plans that’d allow Tesla owners to earn income with their unused EVs through automated ride hailing (regulatory and tech hurdles permitting).

So where’s the intrigue?

First, Tesla’s update opened with some interesting references to world events, including the Red Sea conflict and arson on its facility in Germany.

But second, the competition. There’s plenty now, but China is the biggest by far: its home-grown BYD briefly overtook Tesla as the world’s largest EV-seller late last year, and China alone now accounts for half the world’s EV sales.

But the US, the EU, and others are arguing it hasn’t always been a fair fight. This claim has long been tough to quantify, though Germany’s Kiel Institute just dropped an interesting report, finding China’s state support for companies is (“conservatively“) three to nine-times larger than in places like the EU and US.

And that word “conservatively” is doing some heavy lifting, because it hints at the difficulty of measuring state support in a nation where it can just come via a call to a bank telling it to issue cheap loans; a visit to a utility telling it to lower energy prices; or a text to a government agency telling it to buy local cars only.

The other claim – IP theft – has also been tricky to gauge, though evidence is emerging. German media just uncovered (🇩🇪) a years-long, China-based, EV-focused hack on Volkswagen. And Tesla itself has lodged IP suits, while an FBI sting just detained the co-founder of a China-based supplier on similar claims.

So, both the US and the EU have moved to protect their own auto sectors, with calls to go even harder. And this has prompted China (notwithstanding its own generous state support) to file a WTO complaint.

That’s an awful lot of intrigue for cars.

INTRIGUE’S TAKE

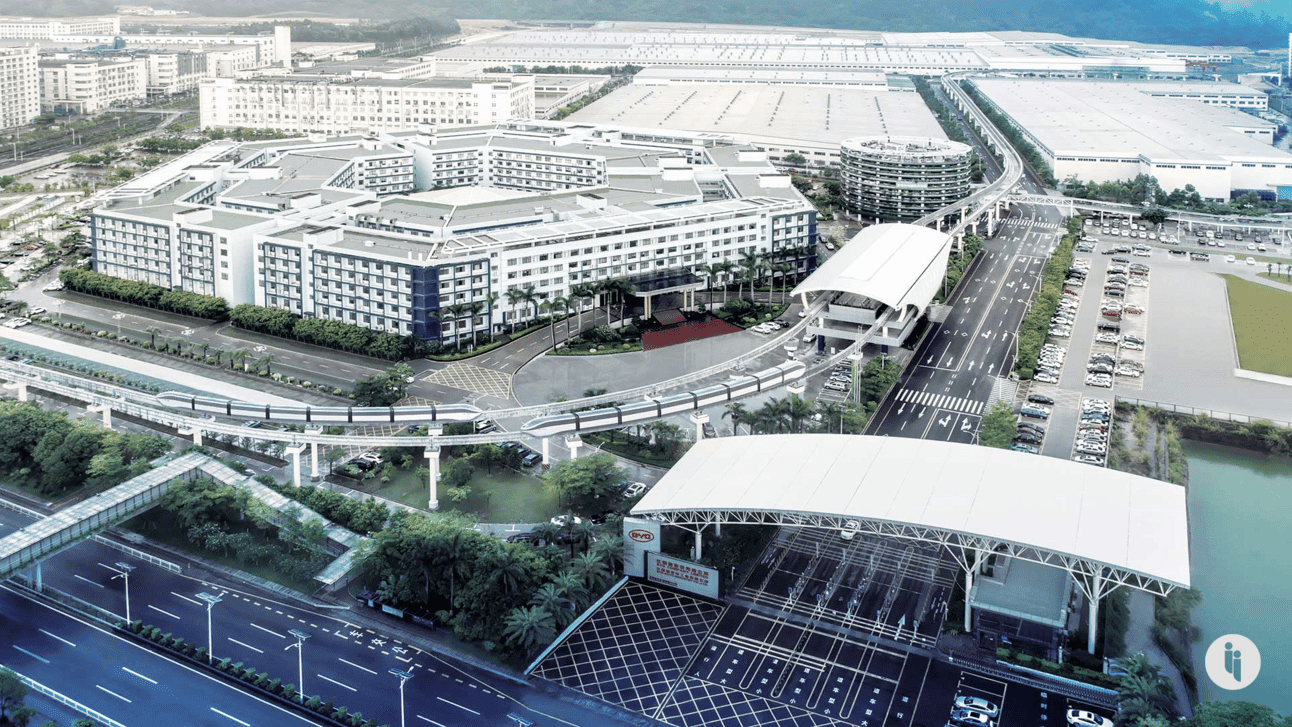

The same year (1995) that Elon Musk founded his first company in Silicon Valley, another entrepreneur 11,000km away in Shenzhen set off on his own journey with BYD, making batteries for Motorola. His name was Wang Chuanfu.

Both Musk and Wang were ambitious, but it’s hard to imagine either thought they’d end up three decades later helming automakers on opposing sides of a geopolitical schism, fuelled by (and fuelling) national anxieties around manufacturing, the energy transition, advanced tech, subsidies, and tariffs.

But ‘opposing sides’ doesn’t capture the complexity at play. Tesla’s second-largest market is China. Its largest plant is in China. Its investors include billionaires in China like He Xiaopeng. Meanwhile, BYD’s largest external shareholders are US-based (Berkshire Hathaway and Blackrock). It supplied America’s largest-ever order for electric buses. It even sells batteries to Tesla.

These are examples of how it’s not only hard to ‘de-risk’ between two massive, integrated economies, but it’s also hard to know who’s ‘winning’ at any one time. But either way, both Wang and Musk are bullish on what’s next.

And on that note – one way to see Musk’s update this week is as an implicit acknowledgement that beating BYD on price won’t be easy. That means competing on product instead, particularly the higher-margin tech. But Wang clearly has a similar idea – he announced a $14B bet on tech R&D in January.

Also worth noting:

- Demand for EVs has cooled globally, as early-adopters get their fix, high interest rates curb spending, and a lagging recovery in China hits consumer confidence. Meanwhile, shares in Japan’s Toyota, which hasn’t prioritised EVs, are up ~33% this year.

- BYD introduced its Blade battery in 2020, using cheaper materials like iron and phosphate to cut costs without cutting too much range. It recently signed a deal to build the world’s largest battery storage project in Chile.