Several major economies posted data this week, offering insights into the state of the global economy.

- Beijing says it’ll no longer post data on youth unemployment, which hit a record 21.3% in June (exports then plunged in July), so…

- The central bank just cut interest rates to support China’s recovery.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 122,000+ subscribers

No spam. No noise. Unsubscribe any time.

- The ruble has nearly halved in value since its peak mid last year, as the world’s most sanctioned country loses export income, so…

- Russia’s central bank has again raised rates to support the ruble.

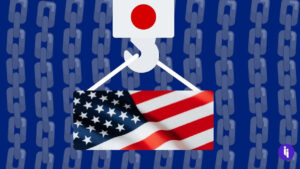

- The world’s third-largest economy grew at an annualised rate of 6% in Q2, double what most economists expected

- This is partly due to post-COVID freight and travel conditions allowing Japan to sell more cars abroad, while welcoming more tourists at home.

Intrigue’s take: As always, there’s more to each story here:

- China’s unique model was slowing well before US-China ties really deteriorated. So Western pressure isn’t the primary cause of China’s current woes, but it does narrow Beijing’s options to address them.

- Russia’s economic survival is thanks in part to its competent central bank chief, Elvira Nabiullina. Once seen as a reformer, she dismayed international admirers by deciding to stay put after the invasion. The ruble’s fate is tied to hers, and Putin knows this.

- And Japan’s net exports aside, most dash-lights (like consumption) are flashing orange right now. So don’t crack that saké just yet.

Also worth noting:

- A spokesperson for China’s statistics bureau said authorities stopped posting youth unemployment data because their stats needed to be “advanced and optimised”.

- Russians withdrew $1.1B in rubles from banks in a single weekend during June’s brief Wagner mutiny.