There was a short but veeeery intriguing piece in Bloomberg over the weekend suggesting the world’s most advanced chipmaker (Taiwan’s ‘TSMC’) is enjoying trial ‘yields’ at its $65B Arizona site that are “on par” with results back in Taiwan.

But to recall why this matters, let’s first set the scene: the US and China are now in open competition, and semiconductors (chips) are a key field where that’s playing out – Taiwan makes 90% of the world’s most advanced chips (with US and Dutch inputs), but China continues to claim Taiwan as its own.

So against that spicy backdrop, the two sides now have duelling strategies…

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 129,000+ subscribers

No spam. No noise. Unsubscribe any time.

- China has a ‘Made in China‘ strategy to curb its own reliance on Western tech, while

- US efforts rest on two pillars: i) using export controls to limit China’s access to top chips (with possible military uses); and ii) using incentives to secure America’s supply by bringing more production back home.

The thing is, both these US pillars have looked a little wobbly lately. In terms of pillar one (limiting China’s chip access):

- FT just reported that top US-designed / Taiwan-made chips are now cheaper to rent in China than in the US (!), suggesting there’s still plenty of supply despite any US restrictions

- The Wall Street Journal also reported some China-based firms are cloaking their identity to rent these same Nvidia chips abroad, and

- We wrote last year how China’s own chipmakers have seemingly shrugged off another US-imposed technical limit on chipmaking (by tweaking legacy tech rather than leapfrogging to the cutting edge).

Then in terms of pillar two (bringing more chip production back to the US), things have looked wobbly despite the US fire-hosing incentives at producers: eg, Intel is bumping up against its own mistakes (like missing the mobile and AI waves), and there’s an entire media cottage industry reporting on hurdles TSMC has faced in Arizona, from cultural clashes to union disputes.

So against those stakes (winning the 21st century) and pillars (restricting vs securing chip access), you can see why Bloomberg’s article caught our eye.

But… this is also why we need to grapple with some legit caveats here: i) these promising TSMC yield claims have come from an anonymous source; ii) they’ve come just as TSMC is in line for $11.6B in US grants and loans; and iii) the technicals are still unclear: eg, can TSMC scale those yields to viable volumes, and at viable costs?

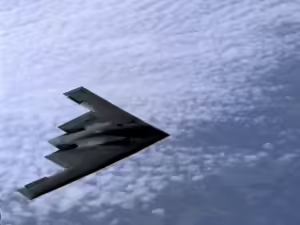

Anyway, in this era of ours, and for this company of Taiwan’s – key to everything from AI chips to F35 fighter jets – it’s all veeeery intriguing, for three reasons:

- First, TSMC’s chips in Arizona are a tiny 4 nanometres, and made with ‘extreme’ ultraviolet tech that’s well beyond the ‘deep’ UV tech still used in China

- Second, there’s a big narrative effect at stake if TSMC succeeds here, particularly around the extent to which the US can still defend and reassert its own tech leadership, but also

- Third, this will stoke questions on whether reducing US dependence on Taiwan-made chips might reduce any US commitment to defend Taiwan; ditto, whether the US cutting China off from top Taiwan-made chips reduces any disincentive for China to take Taiwan by force.

Anyway, with the stakes so high, and information so low, that’s why a 276-word article in Bloomberg left a few ex-diplomats like us more than a little breathless.

INTRIGUE’S TAKE

TSMC’s own story contains seeds of both hope and despair for anyone invested in its success in Arizona.

First, there’s hope in the sense that Morris Chang first founded the firm, at the invitation of Taiwan’s government, after working for decades abroad at Texas Instruments in the US. I.e., TSMC’s very existence is arguably proof that this kind of government strategy can work.

But… there’s maybe also despair in TSMC’s story because it took Taiwan decades, countless billions, and a whole ecosystem of suppliers and educators to succeed, which is probably why this Arizona project has faced delays and cost increases. And that’s probably why Chang himself (now retired) described the whole Arizona play as a “very expensive exercise in futility“.

And yet, if you read his 2022 comments in context, Chang was premising them on an assessment that there’ll be no war over Taiwan. But of course, that’s kinda the point here – whether to avoid a war or win it, chip strength is key.

Also worth noting:

- Around half the 2,200 employees now working at TSMC’s Arizona precinct were reportedly flown in from HQ in Taiwan.

- TSMC’s sales to China have continued to grow via older chips, which aren’t blocked by US export controls.