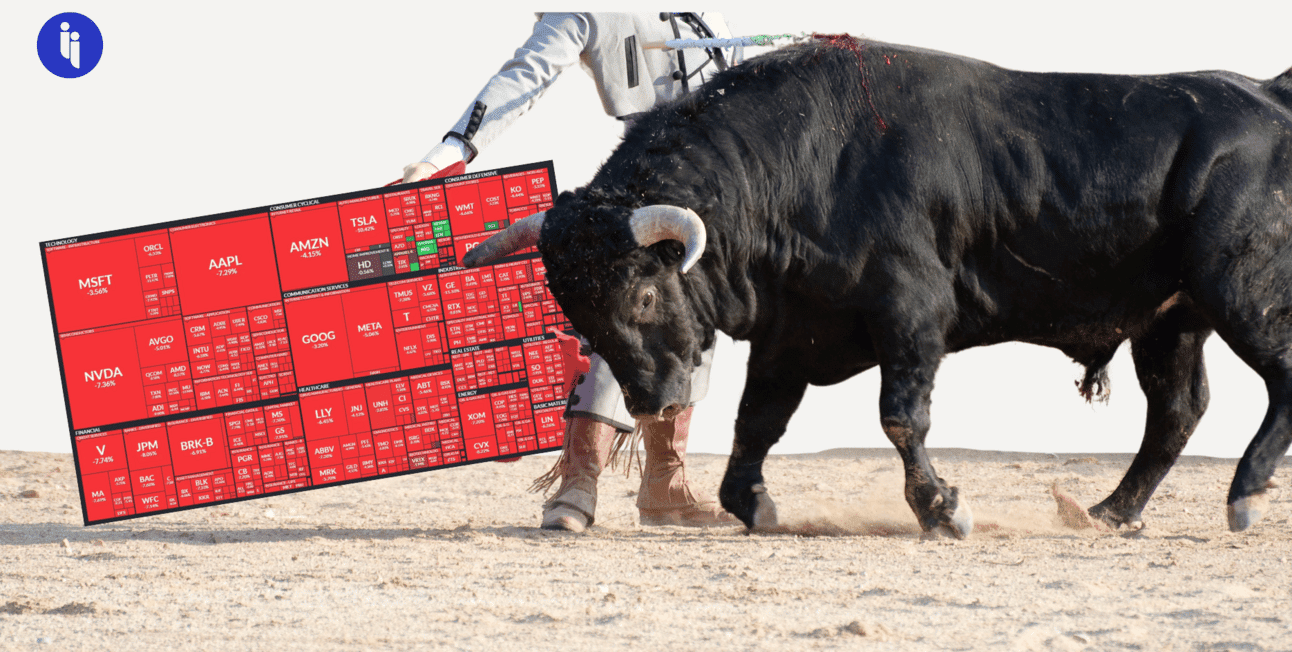

While you might’ve spent your Sunday night watching an epic finale of The White Lotus, traders were glued to something just as wild playing out on their terminals: S&P 500, Nasdaq, and commodity futures allplunged again while folks traded a record 100 million options contracts (a classic hedge), spooking markets across Asia and Europe.

That’s all because whether it’s the oil and gas traders, JP Morgan number crunchers, or Polymarket prediction markets, folks are now seeing a US recession more likely this year as the world digests Trump’s bigger-than-expected tariffs.

So what’s Trump saying?

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 148,000+ subscribers

No spam. No noise. Unsubscribe any time.

Well that’s kinda the thing: markets are partly responding to what Trump and his team were already saying Sunday, framing his tariffs as necessary medicine, rejecting any pause until the broader US trade deficit is curbed, then tripling-down with a defiant tweet.

So as markets continue to wobble, it’s worth looking at three of the arguments Trump’s supporters are mounting:

- This crash is only hurting the elite

Treasury Secretary Bessent has highlighted Friday’s strong jobs numbers, while arguing 88% of stocks (inflated after years of easy money) are still in the hands of 10% of Americans. His point is regular Americans are more exposed to bonds (80% of households have debts). But of course, paying your debts gets harder when you’re out of a job, even if rates drop. And speaking of which…

- It’s about refinancing US debt

There’ve also been arguments (retweeted by Trump) that he’s gaming yields down so he can refinance US national debt at lower rates. But even if you refinance the $10T in US debt maturing this year, a recession will inevitably tank tax revenues and spike social security costs, making that annual $1T interest payment even harder. So maybe…

- It’s just a negotiation tactic

Bessent says 50 countries are already keen to talk, though we’ve only seen a handful in public like Vietnam, Thailand, Israel, Taiwan, and Cambodia. Meanwhile, top trade partners like China, the EU, and Canada are retaliating more than capitulating, and there just aren’t enough Thailands or Cambodias to balance them out. The other things to keep in mind:

- a) Lots of countries now under US tariffs don’t actually tariff the US, so it’s unclear what they’re supposed to offer to have the US tariffs removed, and

- b) There’s little incentive for foreign capitals to offer concessions, given all the speculation that this market reaction will force Trump to back-track unilaterally.

- It’s about reviving the US industrial heartland

Commerce Secretary Lutnick has argued firms will have to open factories in the US to keep reaching the vast US market. But there’s also a risk executives will just quietly hit pause given all the volatility and recession risk. There are also questions around:

- a) Whether US workers want to assemble iPhones (Lutnick’s example)

- b) If there are enough US workers (keen or not) to staff labour-intensive sectors

- c) How the US might source critical inputs still dominated by China, and

- d) Whether Americans would then want to pay ~$10k for a US-made iPhone.

Anyway, whatever you want to make of these arguments, the market ain’t buying them right now. And that leaves Trump with a few options:

- Double down and risk owning the next US recession

- Announce a pause while US officials negotiate a face-saving off-ramp, and/or

- Fire top trade advisors like Lutnick or Navarro (he needs the Wall St darling Bessent to stick around, though there are rumours Bessent wants to quit).

Otherwise, these futures markets suggest we might be waking up to a Black Monday 2.0.

INTRIGUE’S TAKE

Back when Bessent was on Wall St, he assured his investors that Trump’s “tariff gun will always be loaded and on the table but rarely discharged”. But that’s what’s now shocked markets: Trump has pulled the trigger, and not just at China, but also at allies and random bystanders (sorry Lesotho). And it wasn’t just a 10% pistol, but often a 30-40% bazooka.

So these historic rounds will now ricochet in some wild ways. For example, the scale of US-China tariffs is now so high, it’s going to render an enormous chunk of US-China trade non-viable. That’s going to send a wave of low-cost China-made goods washing over other markets like the EU in search of buyers, destabilising local economies further.

So Trump might’ve wanted to showcase US strength, but he might end up showcasing global fragility and interdependence instead.

Also worth noting:

- Goldman is shaving 0.7% off its 2025 US growth forecast just based on Trump’s China tariffs alone.

- High profile investor and Trump backer Bill Ackman has now warned of “self-induced economic nuclear winter”, and argues Commerce Secretary Lutnick’s defensive response to this crash is due to Lutnick’s firm being long on bonds.

- Vanguard has urged investors to hold tight rather than react “with tactical or short-term changes to well-considered investment plans.”