The Swiss-based bank UBS has agreed to a settlement with Mozambique to resolve Credit Suisse’s infamous ‘tuna bond’ scandal.

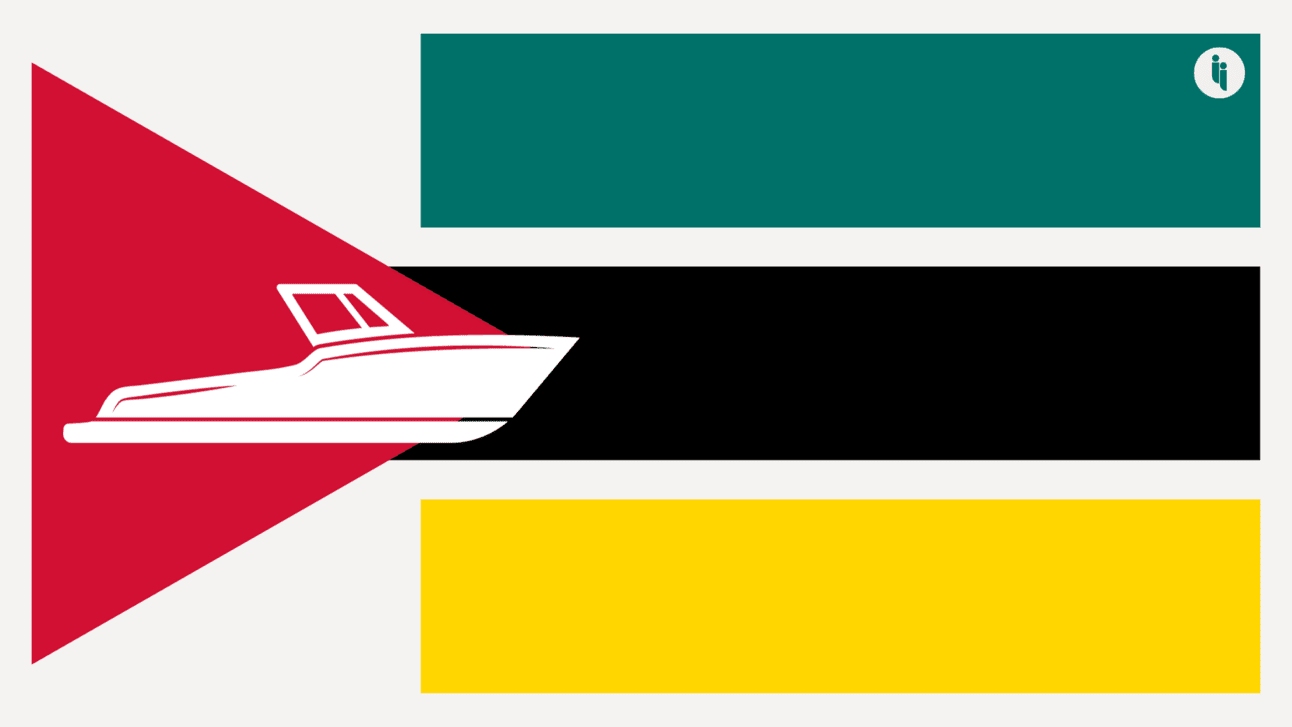

The story goes that Credit Suisse, which UBS absorbed in June, was involved in loaning Mozambique $2.4B in 2013 to purchase a fleet of coast guard and fishing vessels from a company in the UAE.

But the lending program was faulty and plagued by corruption among both bankers and shipbuilders, and Mozambique was unable to pay Credit Suisse back. Huge sums of cash went missing.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 129,000+ subscribers

No spam. No noise. Unsubscribe any time.

So, when the IMF and other international lenders found out in 2016, they halted their own lending, and the country’s economy collapsed.

Intrigue’s take: Lenders have power. Multilateral lenders try to intermediate that power across bureaucracies geared (at least in theory) towards transparency and accountability. But this often means things move slowly.

Private lenders, on the other hand, can move quickly, but this Credit Suisse case is a reminder that speed can cost you transparency and accountability.

Also worth noting:

- Financial regulators earlier fined Credit Suisse ~$425M, and the bank pleaded guilty to wire fraud in 2021.

- Malaysia’s prime minister is threatening further legal action against Goldman Sachs for its role in the defrauding of a state fund.