Indonesia’s benchmark stock index plunged 7.1% within hours on Tuesday, triggering a temporary trading halt for the first time since early Covid.

And that’s captured our attention because first, Indonesia is Southeast Asia’s biggest economy, and second, we were just writing about the conga-line of tech CEOs flying there for a slice of the country’s enormous potential.

So, what’s happening?

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 160,000+ subscribers

No spam. No noise. Unsubscribe any time.

Some of the drivers here are beyond Indonesia’s control — many emerging markets have wobbled since Donald Trump’s election, as a strong dollar, volatile trade outlook, and occasional recession jitters spook investors.

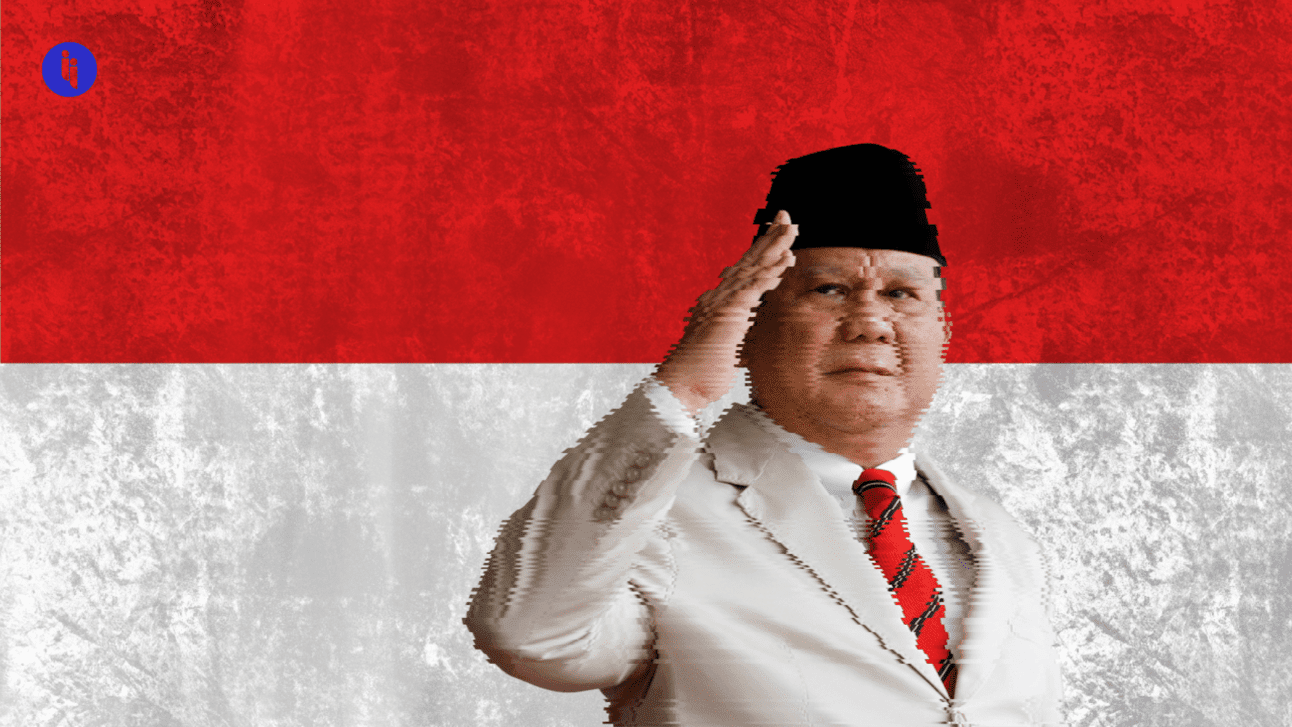

But other drivers here sit squarely within the remit of Indonesia’s new president, Prabowo Subianto. So here are three to consider:

- Centralising power

Prabowo has been in and out of Indonesia’s limelight for decades, whether: a) commanding the country’s Kopassus special forces, b) marrying the daughter of long-time strongman Suharto, c) becoming defence minister after losing the 2019 election, or then d) finally becoming president in October.

But since achieving his life’s ambition, he’s rushed to concentrate power. For example, he can now create unlimited new ministries, and just this week pushed through reforms to allow fellow military brass to serve in government without resigning. Critics argue both moves expand the scope for patronage and populism, and that’s spooked investors.

But what’s the fun in accumulating all that power if you don’t then dabble in a bit of…

- Economic interventionism

Prabowo’s campaign last year really promised more of the same when it came to the economy, essentially riding in the political slipstream of his popular predecessor (Jokowi) whose decade in power featured solid growth and shiny new infrastructure.

But then Prabowo took the reins and shook things up:

- Last month, he launched a new sovereign wealth fund that’ll absorb seven of Indonesia’s vast state-owned enterprises, all answering directly to the president himself rather than his finance minister (Indrawati), and speaking of whom…

- Finance Minister Indrawati just spent days denying resignation rumours after being surprised by Prabowo’s drastic 8% budget cuts (to top up his new fund) — she’s a market darling who’s held the purse strings for 14 of the last 20 years.

And all this just spooks investors even further, particularly when combined with…

- Deflation

Indonesia just posted its first annual deflation in 25 years, potentially reflecting deeper problems like declining demand. And while the solution usually includes expansionary policies, Prabowo is now doing the opposite with his epic 8% budget cuts.

INTRIGUE’S TAKE

The immediate trigger for Tuesday’s 7% crash was probably the rumoured resignation of the finance minister (Indrawati). And the very fact everyone believed this rumour at all reveals plenty of information itself:

- First, recall that Prabowo initially re-appointed Indrawati to her role to help calm markets after winning the election — investors feared his spending plans.

- But second, this only soothes markets if you actually listen to Indrawati and let her hold — or at least be aware of — the purse strings, which brings us to…

- Third, the sheer plausibility of her rumoured resignation stems from the huge gap between her long-standing credibility and Prabowo’s unorthodox budget — there’s no way a market darling like Indrawati would’ve backed it all.

- And fourth, while she hastily called a press conference to deny the rumours and reiterate her pledges to maintain fiscal discipline and transparency, this whole saga suggests maybe those pledges are simply no longer hers to give.

Also worth noting:

- While Prabowo’s budget cuts and other measures have triggered protests, his approval ratings still entered the year above 80%.

- Indonesia’s tax revenues are down 30% this year due to lower commodity prices. Meanwhile, Prabowo’s spending plans include a vast new school meals program projected to cost an annual $29B.