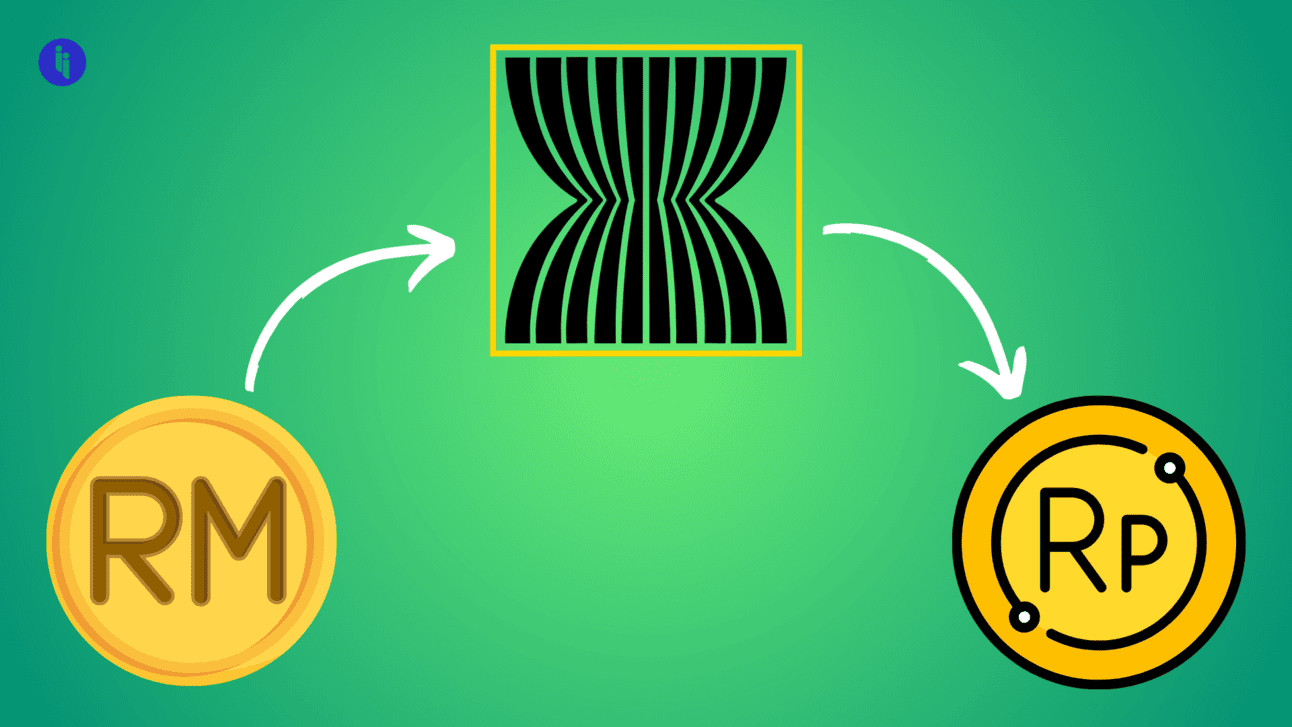

Briefly: Members of the Association of Southeast Asian Nations (ASEAN) have introduced a new system to expedite cross-border payments.

Here’s how it works:

- 📱 a Malaysian tourist in Bali scans a QR code, enabling her Malaysian banking app to process the payment directly into Indonesian rupiah

- 📉 that means she buys her souvenir, without any fees, in Indonesian rupiah rather than converting via US dollars, slashing transaction costs

And some say it could be a step towards an ASEAN common market, especially if this same tech can be used to facilitate bigger transactions like business loans.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 129,000+ subscribers

No spam. No noise. Unsubscribe any time.

Intrigue’s take: It isn’t the disaggregated blockchain future that Bitcoin gurus promised, but the ASEAN QR Code is a real step forward for digital payments.

And it’s one that empowers local currencies, which could ultimately limit the drastic exchange rate fluctuations that have been a challenge in Southeast Asia and (ahem) in the crypto-verse.

Also worth noting:

- Malaysia, Indonesia and Thailand are currently on the new system, with Singapore, Vietnam and the Philippines expected to join later this year.

- The system involves each country’s central bank making a settlement agreement using their local currency rather than the US dollar.