We’re two weeks out from Trump 2.0’s inauguration on January 20, and capitals everywhere are preparing for what that might bring (we shared special editions on some of the thinking in Taipei, Berlin, and Mexico City over the break).

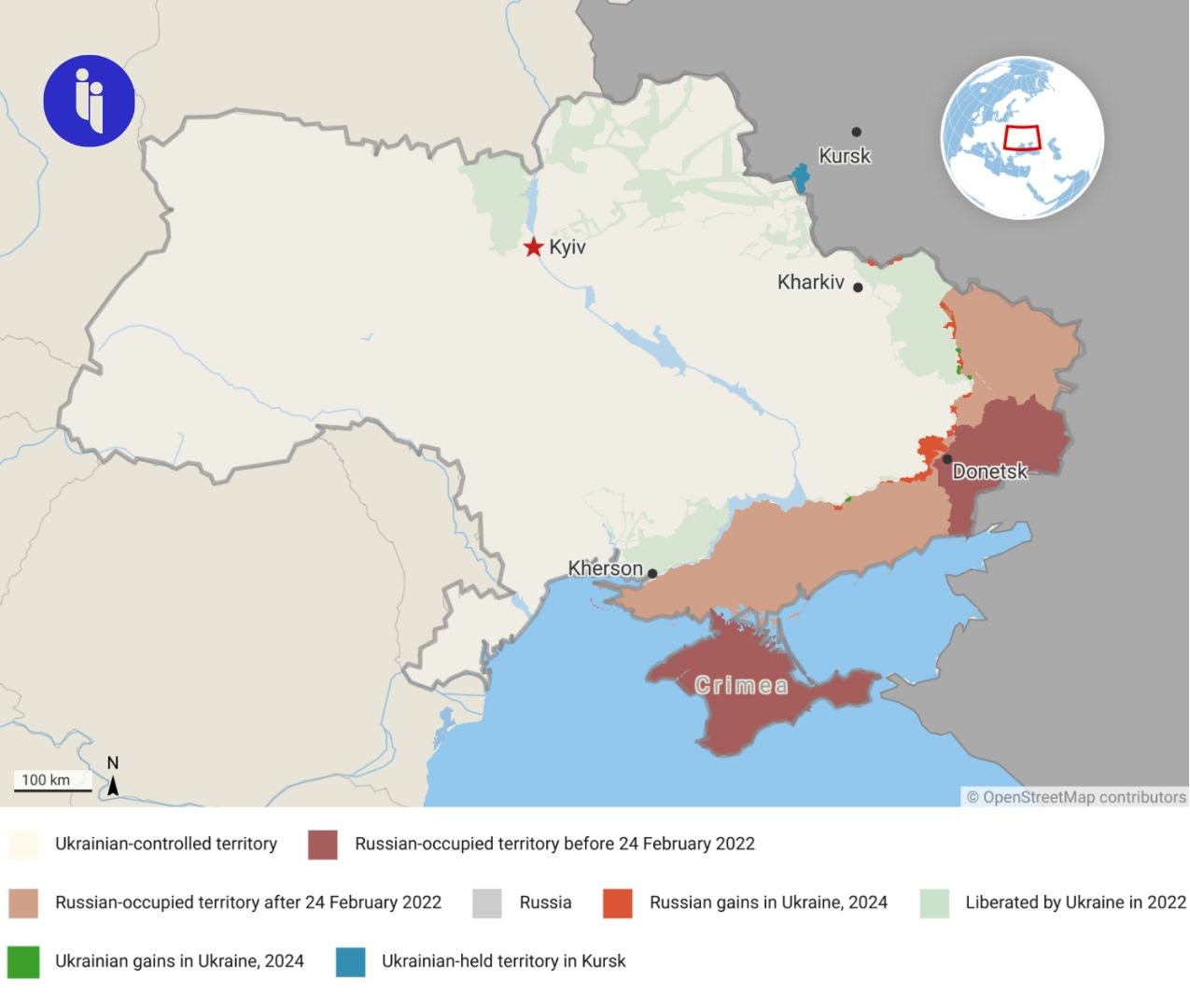

But one of the biggest question marks remains Russia’s ongoing invasion of Ukraine. So let’s take a quick look at five of the big ticking Russo-Ukraine clocks we’ll be tracking through 2025:

- ⏲️ How long can Ukraine hold Russia’s Kursk?

The Ukrainians surprised everyone in August by suddenly seizing a chunk of Russia (in Kursk) the size of Hong Kong. And the Ukrainians are still surprising everyone in Putin’s inability to eject them months later, despite mass casualties and help from North Korea.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 127,000+ subscribers

No spam. No noise. Unsubscribe any time.

To boot, there are now reports (🇺🇦) Zelensky is mounting another surprise push in Kursk, presumably to maximise any leverage — and expose the limits of Putin’s power — before Trump 2.0 potentially tries to force a settlement.

Either way, the move has tied up Ukrainian forces, leaving some to ask…

- ⏲️ How long can Ukraine hold over in its east?

While Ukraine managed to take ~1000 sq km (400 sq mi) of Russia in August, Russia only took around four times that much (~half of Puerto Rico) from Ukraine over the entire year, and still hasn’t managed to take any of the 23 key cities Ukraine held from the outset. But Putin seems to have accelerated his gains while Zelensky is struggling to stabilise the front — eg, there are damning reports of desertions among the much-lauded, French-trained ‘Anne of Kyiv‘ brigade (named after an 11th century Kyiv princess who became queen of France).

And those continued struggles on the battlefield have contributed to…

- ⏲️ Changing popular sentiment

Almost three years into Putin’s full attempted invasion, Ukrainians are tired. Russians are too (see below), but polling just last week suggests around 38% of Ukrainians are now open to Putin keeping some of Ukraine’s land to end the war, up from just 8% in 2022. Meanwhile, 51% of Ukrainians say Ukraine shouldn’t give up its land under any circumstances — that’s down from 85% in 2022. Support for Zelensky is down, too.

But in parallel, a record 73% of Ukrainians now support their country re-developing nuclear weapons, which they surrendered 30 years ago in return for US-UK-French-Russian security guarantees. We’re seeing that rekindled interest in nukes in multiple places, by the way, as rattled capitals everywhere revisit their own security assumptions.

Speaking of which, we’re also revisiting assumptions around…

- ⏲️ How long can Putin’s military sustain this?

Early on in his invasion, there was a narrative that Putin could sustain his war as long as needed. But the numbers just don’t back that up. Last year, for example, he lost something like 3,000 tanks in Ukraine. That’s ten times what he can now produce in a year, and aerial photos of dwindling Russian storage facilities leave real doubts on whether Putin can maintain his ground attack tempo beyond 2025.

And that’s prompting renewed questions around…

- ⏲️ How long can Russia’s economy sustain this?

Few believe Putin’s official 10% inflation stats, and his eye-watering 21% interest rates aren’t hosing things down as much as you’d think, but they are leaving more firms (including key defence players) teetering on the brink. Meanwhile, his ruble is facing bigger and more frequent wobbles, and his piggy bank (the National Wealth Fund) has maybe $30B in liquid assets left (not a lot). To stay afloat, that leaves Putin even more exposed to oil and gas prices, which aren’t moving in his favour.

So Putin continues to hope the West’s resolve breaks before something breaks at home.

INTRIGUE’S TAKE

This war isn’t looking sustainable for either side right now, so maybe that means we’ll see some kind of accord emerge this year — and that’s certainly something we’re hearing more frequently. And yet — it’s hard to see everyone agreeing on the kinds of security guarantees Ukraine really needs to stop Putin from just regrouping and attacking again. So maybe 2025 is the year we see something just snap instead.

It’s impossible to know how, but on the Moscow side for example, keep an eye out for the name ‘Elvira Nabiullina’: she’s Putin’s central banker, widely seen in the West (pre-invasion) as brilliant. She’s pulled every trick (🇷🇺) to defray and delay the costs of Putin’s war so far, which is why Putin has protected her from mounting domestic criticism to date. But Nabiullina is running out of options, and if Putin throws her under the bus (a small but rising chance), that’s a pretty solid indication he’s in trouble.

Also worth noting:

- Dozens of Ukraine’s partners will be meeting at Ramstein Air Base in Germany this Thursday to discuss continued support. Zelensky continues to flag a need for more air defences, given Putin’s continued attacks on Ukrainian cities.